Interview with Isuzu’s Brian Tabel

Switching to EVs can be a smart solution. However, costs, incentives,

timelines and other factors can complicate purchase decisions.

Furniture World engaged Brian Tabel, assistant vice president of marketing

at Isuzu Commercial Truck of America, to explain what retailers need to know

about electric vehicles, specifically the medium-duty trucks used for

furniture last-mile deliveries.

“The big trucking fleets and some large furniture retailers already

understand how to purchase EVs,” he explained. Because many large,

public-facing companies have set sustainability goals for carbon neutrality,

they’ve shown the most interest in EVs. I believe the level of interest

beyond that group is about to expand.

“Right now, internal combustion engine (ICE) vehicles are an excellent

option for furniture retailers. Any switchover will likely take decades, but

EV last-mile delivery trucks make sense for some retailers, depending on

many factors we will discuss.”

Brian Tabel, assistant vice president of marketing at Isuzu Commercial Truck of America.

A Good Fit

“There has been some anxiety surrounding electric trucks due to cost,

available infrastructure and the timing of government mandates. Still, EVs

are a good fit for furniture retailers. That’s because final mile trucks,

unlike larger, long-haul trucks,” he explained, “don’t run hundreds of miles

a day and generally don’t make deliveries in the middle of the night,

leaving ample time for charging. And they are much more efficient than ICE

trucks in terms of operation and maintenance.”

Price

“It’s true that the purchase price of an EV is considerably higher than the

typical ICE vehicle. However, that can be offset by state, county, and city

government incentives, not only for the truck but also for charging

equipment and infrastructure. Sometimes, the all-in purchase price can be

lower than for an ICE vehicle. For example, an $80,000 incentive might be

offered in Anaheim, California, but in Orange, California, less than eight

miles away, it might be $50,000. It’s complicated, so we are working on a

tool to tally the city, county and state incentives for vehicles domiciled

in various locations.

“One unknown concern for retailers considering purchasing an EV is how long

the incentives will continue to be available to help offset most purchases.

Government entities allocate a set amount to fund programs, but as more

customers move to EVs, the pool of money gets depleted faster.”

Right-Sizing

“Purchasing an EV delivery truck is more complex than many retailers know,”

Tabel explained. An ICE vehicle might get 35 miles per gallon under various

conditions. With an EV, any power draw on the truck, including turning on

the heated seat or running air conditioning, has an impact.

“Right-sizing EV trucks requires choosing an appropriate battery pack for

the job at hand. For example, Isuzu offers four battery options, ranging

from 60 to 180 kilowatts. Generally, delivery trucks not driving long

distances need smaller, less costly battery configurations.

“An advantage that furniture retailers have is that delivery loads are much

lighter than those carried, for example, on beverage trucks. That means

furniture loads don’t run at full GVW (total truck weight, including

payload). Topography and climate are more important factors. Model purchase

decisions, therefore, need to be based on questions such as, ‘Will furniture

deliveries be made to homes in the hills of San Francisco or in Miami,

Florida? Will heated seats or air conditioning be running full-time?’

Ambient temperature impacts EV batteries similarly to how it affects cell

phone batteries. Recharging ability is affected by extreme cold. Also, hot

weather can affect an EV battery’s ability to hold a charge.

“The right truck has to fit the conditions and routes it travels. That

usually involves detailed conversations between retailers and local truck

dealers.”

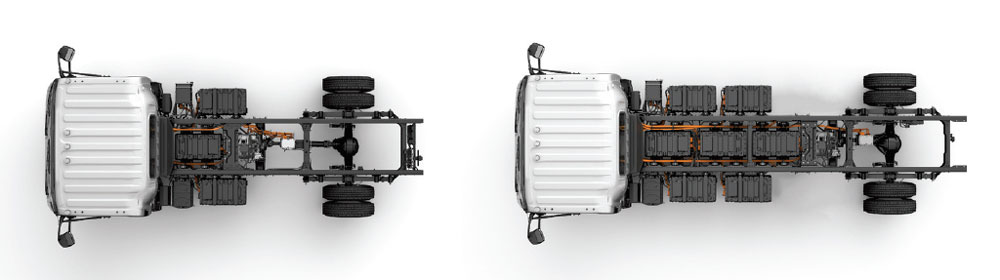

Right-sizing EV trucks requires the appropriate battery pack for the job at hand. Distance,

topography and climate are

factors.

Operation Costs

It’s been estimated that EV trucks incur 30 to 50% fewer maintenance

expenses than diesel vehicles, assuming proper battery maintenance.

“Depending on government incentives, the payback period is accelerated by

lower maintenance needs for EV delivery vehicles, said Tabel. Tires will

likely be the biggest maintenance expense. There’s no oil to change, no

transmission, and no air filters other than for HVAC.”

Charging Station Standards

“Currently, there aren’t formal standards for charging station hookups.

Tesla has the largest network of chargers across the U.S. and Canada. Ford

and Rivian use the Tesla charger, and I think more car companies will move

in that direction over time. Large trucks require more power and will have

their own adapters,” he said, “but our N-Series EVs used for last-mile

delivery trucks use a car-type charger.

“The problem with most charging stations today is that they have car-sized

parking spaces. Pulling up in a 24-foot furniture truck to one of these

stations isn’t feasible. Over the past two years, however, we have seen more

drive-through charging stations suitable for trucks become available.

“Retailers will need to install their own charging stations. An overnight

trickle charge results in a deeper charge. So-called hotshot charges, which

take a battery from 20% to 80% in 30 to 45 minutes, shorten battery life.

“To make charger installation easier, Isuzu has partnered with ChargePoint,

which has the most extensive charging infrastructure in the U.S. and Canada.

They do site surveys and estimate the electrical usage needed. The company

also recommends appropriate chargers and works with power companies to

install them at retail locations.”

“EV truck sales to furniture retailers will be propelled by emissions

mandates originating by the California Air Resources Board (CARB) and on the

national level by the EPA.”

Government Mandates

“In California, regulations dictate that truck manufacturers must sell a

certain number of zero-emission vehicles,” Tabel noted. “In other states,

there are different timelines. Mandated increases in the percentage of EV

trucks manufacturers must sell will come in 2025-2026. And a larger jump

will occur in 2027.

“EV truck sales to furniture retailers will be propelled by emissions

mandates from the California Air Resources Board (CARB) and on the national

level by the EPA. The pace of that change will depend on how fast

regulations mandating EV purchases and limiting sales of ICE trucks roll

out,” he said.

“CARB is considering several timelines for accelerating the transition of

medium- and heavy-duty vehicles to EVs. We are waiting for the EPA to

announce its requirements across all 50 states, at which point CARB may

adjust its timeline further.”

Infrastructure Speed Bump

“I can’t speak for every OEM,” Tabel said, “but I believe that the

aggressive timeline CARB has specified is an area of concern because

sufficient infrastructure isn’t yet in place to support a mass change-over

to EV trucks.

“There just aren’t enough EV charging stations in many parts of the country

to make EVs viable for some businesses. Here’s an example: Every truck

traveling in and out of Manhattan passes through Hunts Point. The numbers

are huge, and installing sufficient underground transmission lines to

support a switchover to all EV trucks would take years—perhaps even a decade

or more to achieve.”

Conclusion

Tabel stressed that EVs are a smart option for furniture retailers going

forward. “While the change can be a little daunting for first-time EV truck

purchasers,” he said, “it can be a smart solution.”

EVs make good economic sense depending on government incentives, especially

in places where there’s a significant differential between the cost of gas

and electricity. They can also help retailers advance sustainability goals.

“From our perspective as an OEM, we look forward as an industry to getting

some certainty from CARB and the EPA regarding the regulatory timeline. It’s

an election year, and I imagine some Furniture World readers are wondering

if there might be a relaxation in requirements should there be an

administration change in November. It’s possible for the longer term, but

realistically, the 2027 efficiency standards will go into effect,” he

concluded.

Questions about this article can be directed to Brian Tabel via

editor@furninfo.com.