Interview with Pam Miller

Here’s how Pam Miller generates traffic, cuts marketing and financing costs, builds loyalty and brings dollars

to her

bottom line.

Before Pam Miller’s family entered the furniture business, all the men in her family were coal miners.

“My great-grandfather,” she said, “broke his back and died in the mines. Along with my grandfather, Jesse

Miller, who

started our business, my dad, uncles, and grandfather were all coal miners. They lived in a small town with a

population

of about 500.

“Jesse saved up enough money for a couple of acres of land in the middle of a cornfield to build a home. Soon

after, a

guy approached him, asking if he needed any furniture. My grandfather said ‘no.’ They started talking, and

Jesse, who

had saved a thousand dollars in a tin can, decided to go into the furniture business. He put four sofas in a

cement

block basement, took out a classified ad, and started selling. A year later, he and his three boys dug the

5,000-square-foot foundation next to his home and opened Miller Furniture. It was 1969.

“They operated like that until 1986, when Dorothy and Jesse Miller’s three sons expanded that building in

Punxsutawney,

Pennsylvania, to 50,000 square feet.

“In 1992, they leased a 10,000- square foot building in DuBois, Pennsylvania, a growing town about 30 minutes

away. The

store name was changed to Miller Brothers Furniture. The brothers bought a 50,000-square-foot furniture store in

DuBois

two years later.

“In the meantime, they opened a little clearance outlet store in Punxsutawney, called Ebenezer’s Furniture, ‘For

the

little bit of Scrooge in all of us’ and leased a former Heilig-Meyers store, calling it, By The Room Furniture.”

Ascendancy

“My family approached me in 2006 to take over the business. At the time, I had been the director of the

Make-A-Wish

Foundation of Western Pennsylvania for almost 20 years.

“My management team thought, ‘Oh, great, we have to work with the owner’s daughter; she doesn’t know a lick

about

anything.’ My dad told me, ‘Sis, you need to go to those Furniture First meetings. That’s really where you’re

gonna

learn.’ In our performance group were retailers like Jamie and Jeff Winter, Steve Kloss and 13 other really

smart people

and mentors. We still meet three times a year.

“In 2010, I approached my dad and my uncle about buying the business, and we created a three-year succession

plan.”

Miller related that it was a long and difficult process leading up to closing the deal. During that time,

banking

regulations changed, and bankers wouldn’t or couldn’t keep up their side of the financial bargain. In three

years, she

owned the company.

“Loyalty sets a retailer apart from its competitors. From the 1960s to the 1980s, there was

loyalty.

Even at the start

of 2000, there was some. But that all went away. Now, retailers have to work hard to earn it back.”

Regret

“About a year after I purchased the business, I started thinking, “This isn’t fun anymore. What have I done? I

didn’t

have a goal and was struggling. A friend suggested I read ‘The Myth of the Entrepreneur.’ The book talks about

passion

and purpose and I realized that my passion in life has always been helping people. It’s what I did at

Make-A-Wish. I

have to credit Howard Freed from Freed’s Furniture in Dallas, who donated 71 tractor-trailer loads of furniture

each

year to the Dallas Furniture Bank. When he told me that, a bell went off, ding-ding-ding. I filed for a

501(c)(3) and

opened a local furniture bank, then started offering our customers cash or discounts when they donated their

gently-used

furniture to put in the bank.”

A Turn for the Worse

“In 2018, sales were down, and my By The Room store took a hit. It was bad, and I was in danger of losing the

store. So,

I called my performance group, letting them know, ‘I need you to come here.’ And they did. The result was that

she

rebranded her main store as Miller Home Furniture & Mattress and hired store designer Martin Roberts to do the

redesign.

The group suggested she convert her By The Room store into an Ashley Home store and make some staffing changes.

“Ashley was great, and approved the location quickly, pending a financial review,” she said. “Well, that was a

scary

thought for me. With $200,000 in the bank and a $500,000 loan, we still needed another $300,000 to get started.

“We planned a remodeling sale at Miller Home and a GOB at By The Room. We started receiving new products, the

sign went

up, and we opened our new Ashley Home store. Business has been glorious ever since.”

A Destination

“Our Miller Home store is a destination location with the highest price point line being King Hickory. We do

have some

Ashley in that store, but it is minimal. We also carry Bassett, England and Flexsteel.”

“The result from our texting campaign since January is sales are up by 565% on DUDLs. Anniversary and

birthday sales are

up by 80%.”

Secret Sauce

“I have a secret sauce, but I have to be careful about sharing the whole recipe. I can tell you that, out of 400

attendees at a Furniture First symposium in Dallas, I won “Best Idea,” which I will now share with you. It

works, even

though some retailers might find some parts of the plan to be scary.”

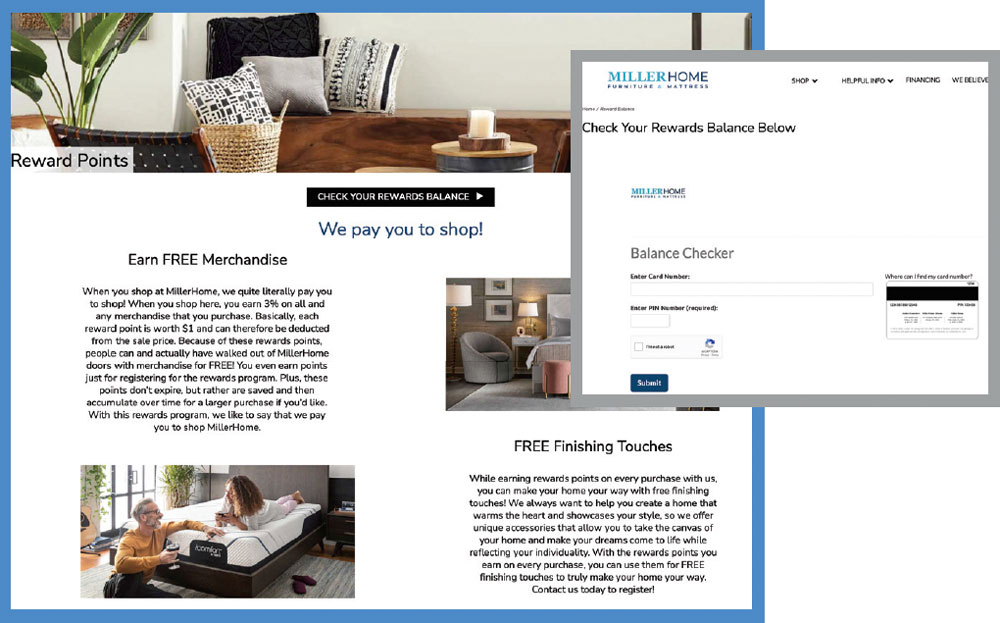

First Ingredient: “The first ingredient is our loyalty program. It’s something that I have been working on for

the past

20 years.

“Ninety-nine percent of the time, furniture businesses say “no” when I ask if they offer loyalty cards to new

customers

and credit a portion of the purchase price to them as a way to encourage repeat business. I know this because,

out of

more than 200 business members, no other Furniture First storeowner has a loyalty program.”

Second Ingredient: “Customers pay a three percent surcharge on credit card processing in my stores. These

charges don’t

need to be entered into our POS system or hit our P&L.

“When I first explained the system to my Furniture First performance group, here’s what happened. I asked them,

‘How

many of you add surcharges to use a credit card?’ The entire group responded they would never do that because it

would

make their customers angry. ‘I believe you all need to think about that,’ I replied. ‘Credit card surcharges

have

already added significant net income to my bottom line.’”

Miller rebranded her Miller Brothers store as Miller Home Furniture & Mattress and opened an Ashley

Home Store.

How the System Works

Miller said that her program doesn’t penalize customers. It’s a powerful way to increase loyalty and sales.

Plus, it’s

an incentive for customers to pay cash instead of pulling out their credit cards, turning the percentage of cash

to

credit purchases upside down.

She gave this example. “When we had our most recent Friends and Family event in May, we did almost a month’s

worth of

business in four hours. It was our usual invitation-only event, not open to the public. The year before, 75% of

sales

were paid by credit card. This time, 75% was paid in cash or by check. The exciting thing was that not one

person

complained. Not one! But let’s say they did complain. Our loyalty program would have come to the rescue. I will

explain

how in a moment.

“At our next group meeting, while going over the numbers, I was asked, ‘Pam, why are your financing fees so

low?’ This

was my answer.

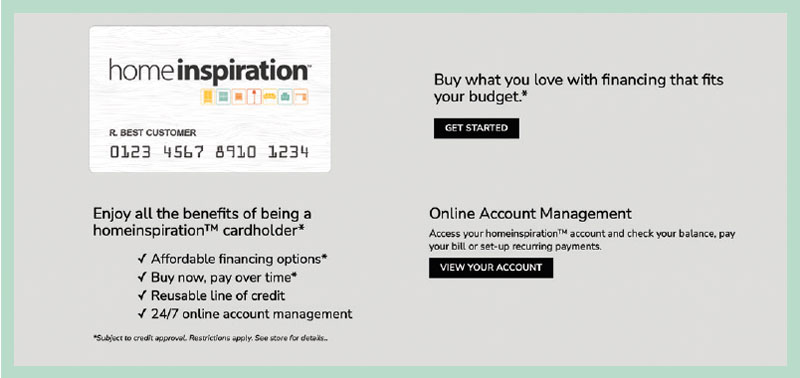

“People think furniture retailers work at a 50% margin, but it’s more like 38% when finance fees are factored

in. I

simplified Miller Home’s payment choices to these four... Pay in full, six months or 12-month financing

interest-free,

or 60 months at 9.99%. Since our customers may already be paying 27% on their Macy’s or Visa balance, that makes

9.9% a

deal for those who need longer to pay. The best part about this is that I don’t lose all that margin on credit

sales.

“Credit card charges and financing fees in the P&L are separate line items. Combined, we increased our net

income by one

percent in a year. These are the things we need to do to survive.”

She believes many successful retailers will be hesitant to follow her lead. “They will be afraid to take the

chance,”

she said. “That’s true even for some of my friends and mentors at Furniture First.”

“Once our salespeople understood how Red Rovering could affect their income, it became a game-changer

for us. The first

month after we started doing this, we had a 120% sales increase.”

Loyalty Points Save the Day

“Now, let me explain,” she continued. “When we ask a customer, ‘Do you want to use your credit card?’ we let

them know

that there’s a three percent surcharge. But we add, ‘I just want you to know, that we give you three percent of

the

purchase price back on your loyalty card. So, if you’re spending $3,000, we will give you $90 back.’ If a

customer is

upset about their delivery experience, we explain, ‘I know you’re upset. You know what? You already have $90 on

your

loyalty card, so I’m going to add an extra hundred because you had a bad experience. Now you have $190 to come

in and

spend.’”

In addition to offering its customers cash or discounts for donating gently-used furniture to put in

the local furniture

bank it founded, the company generously supports local charities.

The Packet Principle

“As I mentioned before,” she recalled, “we’ve been doing this for 20 years and have enrolled 40,000 customers in

our

rewards program.” Miller added that there are additional benefits. “Here’s some really good news,” she said.

“Every

month, my sales team gets a packet listing every customer that purchased a year ago. It includes customer names,

phone

numbers and loyalty numbers, so sales associates can make anniversary and birthday follow-up calls.

“The packet also includes DUDLs, the names of customers who purchased protection five years ago.” The acronym

stands for

Don’t Use It, Don’t Lose It. “Our sales associates call DUDLs to let them know, ‘We will give you back this

money

in-store. Stop by in the next 30 days, and you will have $499 worth of free money to spend.’

“When they get their monthly packet, a salesperson might notice that Mrs. Smith has a $150 balance in her

loyalty point

account, which she might have forgotten about. They might say, ‘Mrs. Smith, I’m calling to wish you a happy

birthday.

We’re going to add $25 to your loyalty points for your birthday. That will give you $175 to spend.’”

“I frequently tell my employees that the more furniture we sell, the more people we can help. Is that

why people walk in

the door? Some do.”

Text Success

“In January, we started a texting campaign. A text might read, ‘Happy Anniversary! It’s been a year since you

purchased

from us. We’re going to add 25 points to your loyalty card. Click on this link to see how much money you have.’

Or,

‘Don’t use it, don’t lose it. You have free money to use for 30 days.’ Since January, the result from our

texting

campaign is that sales are up by 565% on DUDLs; Anniversary and birthday sales are up by 80%.”

“We also do Red Rovers. If a customer doesn’t buy from one of our stores, we Red Rover them to the other store.

They

receive a little card showing kids holding hands that reads, ‘Red Rover, Red Rover, let Tommy come over.’ If

customers

Red Rover to the other store, they get $25 to spend. The salesperson who Red Rovered them gets 10% of the sale

if they

buy at the other store, which is just four miles away.

“Once our salespeople understood how Red Rovering could affect their income, it became a game-changer for us.

The first

month after we started doing this, we had a 120% sales increase.

“Sometimes a couple will visit one of our stores and tell the sales associate, ‘We were looking for a sofa but

didn’t

see anything we liked.’ If the salesperson can’t sell or quote them, they’d better be Red Rovering! The

alternative is

to let the customers leave to shop at a competitor or Big Lots. If they Red Rover a shopper who purchases at our

other

store, they fare much better.”

Miller shared that store sales were up by 36% in May, and traffic was up by 48%. It’s an exceptional feat in the

current

economy. It’s even more impressive because her stores serve a moderate to low median income three-county area

hit hard

by recent inflation.

“There’s a range, of course,” she noted. “We have a huge hospital here and an area called Treasure Lake full of

higher-end vacation homes.

“Loyalty sets a retailer apart from its competitors,” Miller continued. “From the 1960s to the 1980s, there was

loyalty.

Even at the start of 2000, there was some. But that all went away. Now, retailers have to work hard to earn it

back.

“And that applies equally to retail team members. I believe that the best way for us to earn their loyalty is to

have

their backs. Our people know that we will be there for them through thick and thin. One of the keys to our

success is a

team of people who will climb Mount Everest for us—and they do.

“Self-interest is part of human nature. People need to know what’s in it for them. That’s why furniture store

owners

need to think about how each decision affects their staff members, not only their company.”

“Miller shared that store sales wereup by 36% in May, and traffic was up by 48%. It’s an exceptional

feat in the current

economy.”

Incentivizing Salespeople

Miller explained that when a salesperson gets their monthly packet and, for example, makes a Don’t Use It, Don’t

Lose It

call, the salesperson might find out that the customer can use a recliner or living room suite. Since customers

need to

use their loyalty dollars within 30 days, it’s easier for the salesperson to make an appointment, print out a

certificate, get them in the door and make a sale. But if a salesperson doesn’t make the call and the customer

responds

to a text I sent instead, one of their co-workers will likely get the up.

“Store owners and salespeople might think that we are just giving the money away, but based on our numbers, they

aren’t

just gifts given to build loyalty. They might also think that our average ticket on DUDLs would be low—just

slightly

higher than the loyalty reward. In fact, our average DUDL is $1,587, with some people purchasing the minimum and

others

over $5,000.”

“The loyalty program is the glue that drives traffic, motivates salespeople and allows Miller Home to

cut operating

cost. Sales calls, texts and information at millerhome.com remind customers to come back and use

their rewards balances.

Goal Marketing

Furniture World readers may have figured out by now that Miller is extremely goal-oriented.

“Here’s my most current project,” she explained. “I have 50,000 people in my POS system, but the database only

includes

24,000 cell phone numbers that I can use for texting. Guess what? I want all 50,000! I already mentioned that

when I

started texting, our traffic increased by 48%, and we booked more sales in a week than relying on a direct mail

piece

that cost $20,000 to send out. If I can get to the point where I’m only texting, just in direct mail savings, I

could

bring a significant amount to our bottom line.

“When I accomplish this, I won’t need to do much else in the way of advertising. It’s not easy to do, but I have

plenty

of ideas”

“I simplified Miller Home’s payment choices to these four... Pay in full, six months or 12-month

financing

interest-free, or 60 months at 9.99%.”

Store Experience

When asked to describe the customer experience in her stores, Miller replied, “Both of our stores look beautiful

and are

kept in tip-top shape. We carry the right furniture and mattresses—all big, white rectangles. They are similar

to what

other retailers carry. So why do people come back to shop here? Aside from the programs we discussed, I believe

it’s

because we give so much back to our community.

“I frequently tell my employees that the more furniture we sell, the more people we can help. Is that why people

walk in

the door? Some do. Our furniture bank is a big part of that. When a customer purchases a mattress for $999 at

Miller

Home or Miller Home Ashley HomeStore, we donate a new mattress to a person in need. Requests for mattress

giveaways have

doubled this year. Seventy percent of these were for children who didn’t have a bed to sleep on.

“These programs are what make us different. But do people really care about Miller Home’s desire to make the

world a

better place? My passion might not be their passion, and that’s okay. But for me to achieve my goal, I need to

build

loyalty. And I’ve found that the information I’ve shared with Furniture World readers in this

interview—explaining what

we’ve done with loyalty, credit, with texts, calls, DUDLs, Red Rovers and all the rest, is the best way for me

to get

there.

“I like to think that if people in our area were asked to name the top three things about our stores, a giving

spirit

would be at the top of their lists. Life is not about how much furniture is sold or the amount of money made.

It’s about

trying to make this world a better place and helping as many people as possible along the journey.”

Conclusion

“The secret sauce for many retailers who want to add an additional one percent to the bottom line is simple,” she

concluded. “Add a surcharge to customer credit card purchases and start a loyalty program. You will attract

customers

who will want to return, which will result in increased traffic and sales.”