Interview with Richard Harris, Orbit Interactive

It’s a perfect storm for digital marketers that threatens substantial legal

exposure, increased compliance costs and reduced clarity in linking digital

spending to ad effectiveness measures.

Over the past 20 years, home furnishings retailers have benefited from a

steady stream of digital marketing advances. These have allowed retailers to

use sophisticated data collection to identify and deliver content to

shoppers in an increasingly granular way. For better or worse, depending on

your view of consumer privacy, all that is about to change.

Furniture World spoke with Richard Harris, Vice President of Digital

Happiness at the marketing agency Orbit Interactive (orbitinteractive.com)

to provide context for legislation that is changing how retailers approach

digital marketing.

Orbit Interactive was founded 15 years ago as a white-label digital

solutions provider. “Along the way,” noted Harris, “we added support for

regional and national ad agencies and now work directly with furniture

retailers.”

He’s worked for Yahoo, Google, CBS, Fox, Cox Media, the federal government,

and others. In 2017 he joined Alex Cantos, Orbit Interactive’s CEO, to

develop ways to help their retail clients bring in customers. “We can do

everything from sending targeted text messages to deliver video to potential

customers at a gas station pump. Today it doesn’t make a difference how

messages are delivered on the digital side. The important question in front

of every home furnishings retailer is ‘What’s the best way to reach a

particular customer?’”

Data Privacy Concerns

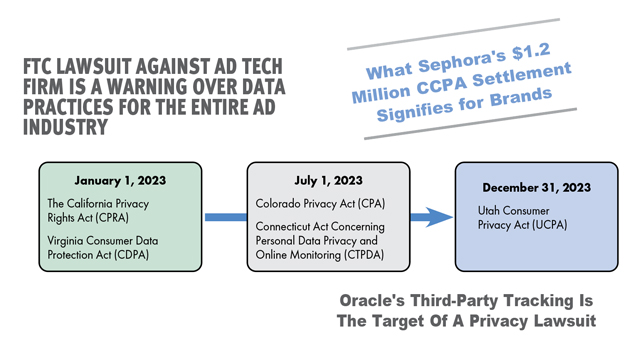

“Right now, every retailer should immediately become familiar with states

that already implemented digital privacy policies or will by the end of

2023.”

Over the past two years, data privacy has become one of the main topics of

concern among marketers. Harris noted that legislation is already in place

for 2023 that mandates privacy-safe data collection. Not only will retailers

be held accountable for how they use the data they collect, but they will

also need to validate that this data is stored in a way that keeps it safe

from hacks and other leaks.

“Another huge marketing challenge for Furniture World readers,” he

explained, “is that third-party cookies will disappear. It’s inevitable and

will transition us to a world where retailers cannot legally purchase

behavioral data collected by a third party, then use it to target potential

customers.

No company will be immune from legal penalties as privacy lawsuits are

moving beyond the largest platforms. Ongoing privacy legislation will continue to challenge ad targeting,

measurement, and ROI—crucial tactics that brands require to survive

and thrive. Source: Orbit Interactive.

“I worked on the European side when privacy protections were being put in

place. It was a nightmare, to say the least. But once it was up and running

and everybody knew what the rules were, it was okay. Europe is well ahead of

the U.S. regarding privacy and the internet. For example, in North America,

we’ve rolled out G5 mobile plans, but Europeans already have G6 and are

working on G7.

“The problem for marketers here in the U.S. is that the digital playing

field lacks clarity and consistency. The House Energy and Commerce Committee

approved the American Data Privacy and Protection Act in 2022,” Harris

continued.” The bill states that its purpose is to “provide consumers with

foundational data privacy rights, create strong oversight mechanisms, and

establish meaningful enforcement.”

“Sending an offer based on the exact red sofa someone looked at online is

much more effective than providing a more general discount coupon, but it

requires a website that includes a full inventory feed.”

Harris worries that if that legislation doesn’t move forward, a frightening

can of worms might open that lacks clear and cleanly defined regulations.

That scenario would unnecessarily complicate privacy and transparency in

digital data communications.

Practical Counter-Measures

"The underpinning of this issue, “ Harris said, “is that retailers need to

roll out successful data-driven marketing campaigns that depend on

effectively using consumer data, product data, data trends and platform

data.

“Right now, every retailer should immediately become familiar with states

that already implemented digital privacy policies or will by the end of

2023. These include California, Colorado, Virginia, Connecticut, and Ohio.

“The rules are a moving target, but at the end of the day, affected

retailers will need to provide proof that they are keeping consumer

information private and are not reselling it or using it to do anything

deemed inappropriate. In California and Colorado, retailers will need to

show that information is locked away so that it cannot be stolen. There are

a number of companies popping up to help retailers with compliance.”

Targeting in This New World

“Digital marketing has relied on third-party cookies for some time. In this

world, whether individuals are digitally connected through a cable line,

streaming television or internet connection, Internet service providers can

track their usage. ISPs collect hours, days, and even years of data based on

searches and activities. Every time consumers arrive home from work, their

mobile devices download their caches to internet service providers via

Wi-Fi. When we transition to a cookie-less world, marketers won’t be able to

purchase this customer-specific third-party data. Instead, retailers will

need to use broader measures and apply predictive models that won’t be as

invasive or easy to apply.

“The challenge for marketing going forward,” Harris predicted, “is how to

prepare for doing business in what is now called a zero data or zero-cookie

world.”

“Marketers won’t be able to purchase this customer-specific third-party

data. Instead, retailers will need to use broader measures and apply

predictive models that won’t be as invasive or easy to apply.”

No Cookies for You!

“Without third-party cookies, it will be harder for retailers to identify

individual furniture shoppers unless they visit a retailer’s website or

directly engage with a store.“ Harris said, “Retailers will still be able to

target based on demographics, spending power or a customer’s purchase

history. But going forward, the highest value information used for retail

marketing will come from shoppers who visit websites and voluntarily leave

their information. That’s why retailers that are not doing everything they

can to facilitate first-party data collection on their websites will find

themselves in a very bad place.

“Without this first-party data, they will be at the mercy of Google,

Facebook and Amazon,” observed Harris. “These three companies hold 83

percent of all the data out there and have no problem charging retailers

whatever they want.”

Why Ruin a Good Thing?

Harris noted, “Third-party data is generated based on the places people

click, pages they visit and keywords they search—leaving a trail of

breadcrumbs across the web. That’s why federal and state government bodies

and companies concerned with transparency are working to eliminate it. It’s

not a secret to consumers that companies can and do know everything about

them. For example, it’s easy to predict with some certainty how often, and

the exact day, an individual consumer will go grocery shopping. And, with

that information in hand, marketers can deliver ads timed to affect a next

grocery purchase.

“From any retailer’s perspective, the marketing goal is to deliver ads that

are more targeted, timely and effective. But when consumers feel like

they’re being spied upon, they feel uncomfortable. That’s why we have a

transparency issue right now. Marketers are being challenged to create new

ways to deliver the best ad information possible to prospects without

digging too deep into their personal lives.”

First-Party Data Will be OK

First-party data will not be affected by new digital norms because consumers

will have a choice of whether or not to accept cookies.

“Accepting a cookie is a type of digital handshake that says to a visitor,

‘Now we know who you are,’” Harris explained. We can verify if you’ve been

here before, and we will continue to add all the new pages and items you

look at to the information we already know about you.’ This cookie data

provides retailers with a profile of who a shopper is, how long they’ve been

looking for something and what they are interested in purchasing. For some

website visitors, it’s one page in and one page out. Others will have

visited a retailer’s site multiple times and looked, for example, at every

possible dining table shown on their website over a period of months. Having

this first-party data in hand presents an opportunity for a retailer to send

special offers for the exact sofa a customer has landed on most often.

Signal Loss: Brands have been forced to measure success with metrics

that are less reliant on depleted signals.

Weighted Acquisition Cost (WAC)= Total Ad Spend/ Number of New eCom

Customers

Advertising Cost of Sales (ACOS) = Total Ad Spend/ Total eCom

Revenue

Marketing Efficiency Rating (MER) = Sales Revenue/ Total Ad

Spend

“Most furniture retailers are not using collected data to do this,” observed

Harris. “Some are performing general site re-targeting based on identifying

consumers who visited their website. They may be able to determine that a

shopper has looked at sofas or even, for example, mostly red sofas. Sending

an offer based on the exact red sofa someone viewed online is much more

effective than providing a more general discount coupon, but it requires a

website that includes a full inventory feed.”

First Steps Toward Compliance

Furniture World asked Harris to share the steps retailers might take to

collect and effectively use first party data.

“Leveraging first-party data in a dynamic way,” he replied, ”is going to be

very important in 2023 and an absolute necessity for furniture retailers in

2024.

“The first checklist item is to find a way to collect it. There are basic

ways such as asking visitors if they want to sign up to receive a

newsletter. And, of course, asking for that cookie.

“Next, a plan must be put in place to store data. Will it be stored in the

cloud on a platform like Snowflake (snowflake.com). If so, what guarantees

are there that the data collection and storage are secure? Once data is

collected, further decisions need to be made regarding the specific

information needed to make website visitors more likely to buy.”

Find Your VDP

Harris noted that in the automotive world, website visitors who spend more

time viewing a VDP (vehicle description page) are more likely to show up to

test drive a vehicle. “It’s the page,” he said, “that explains how much a

car weighs, how big the trunk is, back seat legroom and other details.

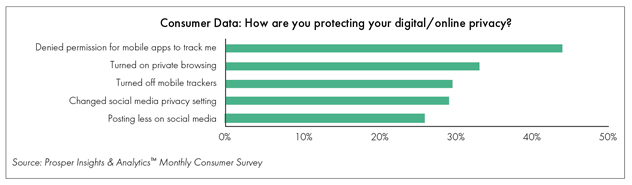

Consumers are (understandably) becoming more cautious and selective

about the information they’re willing to share with brands. According to

a recent Prosper Insights & Analytics survey, over 44% of adults 18+

have denied permission for mobile apps to track their activity, and 33%

have turned on private browsing to protect their digital privacy.

Consumers are (understandably) becoming more cautious and selective

about the information they’re willing to share with brands. According to

a recent Prosper Insights & Analytics survey, over 44% of adults 18+

have denied permission for mobile apps to track their activity, and 33%

have turned on private browsing to protect their digital privacy.

“First-party data that identifies website visitors who spend time on VDPs

gives dealers an opportunity to re-market to those shoppers. Auto dealers

may present website visitors with the next feature or benefit of a car

they’ve shown an interest in, encourage them to set up a test drive or

provide additional value incentives on a particular vehicle.

“Furniture retailers generally don’t use their first-party data in this way.

Even if they track the number of website visits and page views over time to

provide a measure of ad buy effectiveness, they could do so much more to

engage and re-market based on the first-party data they collect.

“Obviously, there are players in the home furnishings market that use

advanced techniques, but many haven’t changed their marketing strategies

much over the past 20 years. These players need to find a way to drive

walk-in store traffic other than continuing to scream sale, sale, sale.”

“Digital privacy is going to be lawsuit as well as paperwork driven,” he

predicted. “California is already starting to stretch its legs in this area.

Sephora recently paid $1.2 million to settle a lawsuit as part of the

state’s enforcement of the California Consumer Privacy Act. There have been

other fines levied as well, though most so far have been ‘shots across the

bow’ to warn retailers to pay attention. Larger companies not located in

California but that do business there can also be fined. Be aware that fines

can add up quickly because the CCPA includes provisions to penalize

retailers per customer incident.

Legal Exposure

In the January/February issue of Furniture World, industry observer Tom

Liddell spoke about the risk of lawsuits against retailers for non-ADA

compliance (see

www.furninfo.com/furniture-world-articles/4039). Harris noted that web privacy data compliance will present a similar,

possibly larger risk.

“Digital privacy is going to be lawsuit as well as paperwork driven,” he

predicted. “California is already starting to stretch its legs in this area.

Sephora recently paid $1.2 million to settle a lawsuit as part of the

state’s enforcement of the California Consumer Privacy Act. There have been

other fines levied as well, though most so far have been ‘shots across the

bow’ to warn retailers to pay attention. Larger companies not located in

California but that do business there can also be fined. Be aware that fines

can add up quickly because the CCPA includes provisions to penalize

retailers per customer incident.

“We’ve all seen news stories about huge judgments against banks, the result

of class action lawsuits, for failing to protect client financial and

personal data. From now on, furniture retailers may be held liable for data

breaches of furniture shopping information. “That’s why every retailer needs

to ask the following questions:

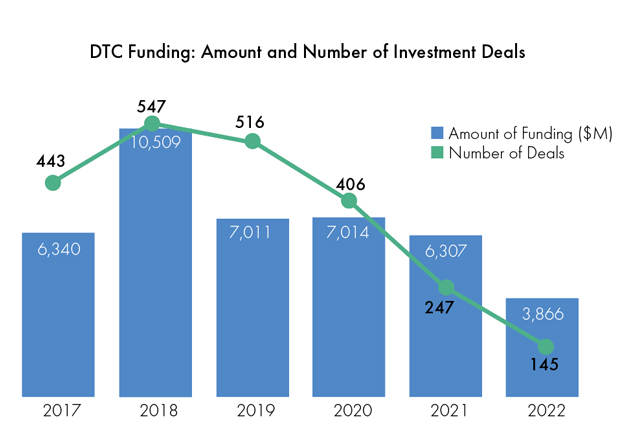

Signal loss, the result of operating system privacy change, is a key

driver of decreased DTC company valuation and funding. Unable to

optimize effectively, Direct To Consumer (DTC) companies are now

spending more money to get fewer results. “The iOS 14 privacy changes

affected everything... The internal metrics and mechanisms that Meta

uses for attribution are off somewhere around 30, 40 or 50%.” Source:

David Herrmann, Herrmann Digital, LLC.

Signal loss, the result of operating system privacy change, is a key

driver of decreased DTC company valuation and funding. Unable to

optimize effectively, Direct To Consumer (DTC) companies are now

spending more money to get fewer results. “The iOS 14 privacy changes

affected everything... The internal metrics and mechanisms that Meta

uses for attribution are off somewhere around 30, 40 or 50%.” Source:

David Herrmann, Herrmann Digital, LLC.

- How do I put data in a secure lockbox?

-

What client data is sitting on an insecure hard drive somewhere in an

excel sheet or a Google Doc format?

-

How can I protect myself from a hack that results in a class action suit?

“Clearly, customer information can no longer sit on an external hard drive

or be backed up in Dropbox. Understandably, a single-store furniture

retailer might not want to spend $2,500 a year on a privacy system, but the

cost of not doing so may prove to be a business-ending mistake.”

Cookie Questions

We’ve all seen websites, especially those for European-based companies,

which allow visitors to choose the kinds of cookies they will accept along

with detailed explanations (See an example at

https://www.natuzzi.com/us/en/cookie-policy). The choices vary, but may include options to allow retailers to use

cookies that are labeled necessary, used to collect statistics or for

marketing purposes.

“U.S. regulations will be basically the same as Europe’s,” explained Harris.

“Europeans can also view data already collected about them, then correct or

remove it. I’ve not seen a single U.S. retailer that has this functionality.

It’s one of the current requirements mandated in the California and Colorado

regulations as of January 2023.”

Consumer Behavior: “Research shows that when a visitor

encounters a website that provides a choice of cookie options, about 25

percent of consumers just say ‘no’ and continue to browse the site. The

result is that the site owner can’t collect data on those visits. At the

same time, about 35 percent of visitors ignore the question and continue to

trudge on through. Technically those who don’t answer shouldn’t be allowed

to proceed, but many websites allow them to do it anyway.”

Out of Compliance: “Lots of U.S. retailers are already out

of compliance and need to play catch up. Our company can advise our clients

on certain aspects of security and privacy, but retailers need to hire an

experienced specialist to help them handle data security. We are

investigating a number of these companies and will be glad to suggest names

to Furniture World readers. One that looks promising is Safeguard Privacy

(safeguardprivacy.com). There

will probably be 100 more to add to this list over the next six months.

“Clearly, California-based retailers and others that are or will be out of

compliance soon, have a pressing need to get this done quickly.”

Business Nexus: “Originally, California said retailers with

headquarters in other states were obligated to follow California Consumer

Privacy Act rules. They have loosened that requirement up a little bit. For

out-of-state retailers that do significant sales volume in California,

there’s a substantial risk. A small retailer headquartered outside of

California that happens to have a couple of customers in there is probably

OK.”

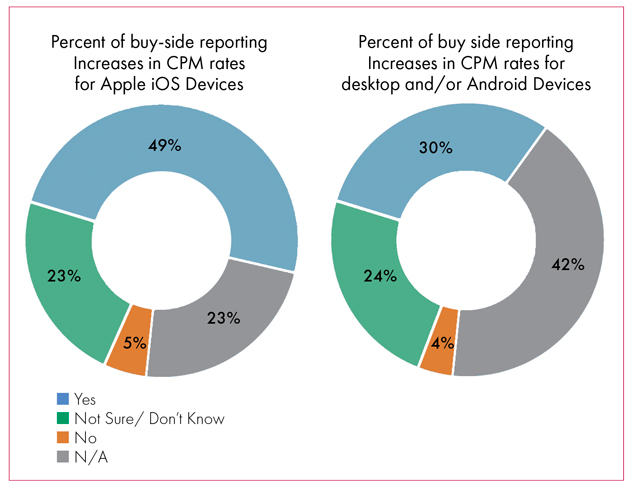

Industry leaders say their revenue and margin won’t be affected but the

data shows that the buy-side has been hit financially: Approximately

half are seeing increased CPMs on iOS and 30% are seeing increased CPMs

on Android following Apple’s iOS 14.5 release. Source: Internet

Advertising Bureau research’s 2022 survey of brands and agencies.

Industry leaders say their revenue and margin won’t be affected but the

data shows that the buy-side has been hit financially: Approximately

half are seeing increased CPMs on iOS and 30% are seeing increased CPMs

on Android following Apple’s iOS 14.5 release. Source: Internet

Advertising Bureau research’s 2022 survey of brands and agencies.

Smart Phone Privacy Changes

When asked about recent updates to smartphone privacy, Harris explained that

“Starting with the iPhone OS14 update in late 2020, mobile phone users have

been able to turn off ID location so marketers can’t track their devices.

“Right now, they can still collect information using a mobile ad ID (MAID)

that’s part of every mobile app out there. But it’s only useful for tracking

when an app is turned on. The result is that marketers have lost a lot of

marketing insight due to a large drop in their ability to see shoppers’

mobile devices.

“This loss doesn’t mean that geofence is going away, but it’s not as useful

as it used to be for targeting potential customers. At this point, everyone

is trying to develop a mobile strategy that’s scalable and reliable while

meeting privacy and addressability rules.

“Are there going to be new ways to improve our ability to market using

mobile devices? I believe that there will be. But I don’t see a technology

combined with platforms that promises a truly bulletproof and future-proof

ROI to get there right now.”

What Remains For Marketers?

Harris says that there are a lot of products out there that retailers can

effectively use. It just means geofence may not be the one that’s best for

some retailers. “Five years ago,” he recalled, “retailers could put a

geofence on their competitors, target them with ads, then see how many

people walked into their stores. Today, running the same number of ads on

top of the same geofence might result in being able to identify just

one-twentieth of the number of walk-ins. Five years ago, we could verify the

advertising ROI. Today we are forced to guesstimate. There are some ways to

get around this issue, but the current mobile device situation has forced

retailers to use traditional measures of ad effectiveness.”

That doesn’t mean that the advertising isn’t turning shoppers into buyers,

Harris explained. “Only that it’s going to be harder to measure. Many

retailers will need help from companies having access to a database of

results achieved by other similar retailers. Ideally, this information

should be driven by AI or data collected from multiple clients, tested on a

variety of platforms with thousands of clients in diverse markets.”

Conclusion

The fact is that the advertising landscape is changing right now due to the

convergence of lots of factors.

Harris said that some of this change will be driven by the recent turnaround

in the profitability of tech giants. “It will cause them to change their

policies and ways of doing business.

“And, as we’ve discussed previously,” he continued, “privacy legislation has

the potential to hurt both large and small home furnishings retailers.

Successful companies will focus on the entire marketing ecosystem then

utilize every tool available to compensate by handling privacy compliance in

the right way. A big part of achieving success will be to utilize organic

website traffic to maximize the collection and use of first-party data.

Remember that at least 80 percent of the people visiting retailers’ websites

don’t buy anything. Not doing enough right now to leverage those visits has

the potential to be a big miss for a lot of retailers,” concluded Harris.