Interview with Tom Liddell, Planned Furniture Promotions, Inc.

There will be winners and losers in the furniture retail community this year.

Industry observer Tom Liddell provides insights into what may be in store.

Furniture World recently spoke with Tom Liddell, senior vice president,

director, Planned Furniture Promotions, Inc., to get his thoughts about the

likely challenges and opportunities facing furniture retailers in 2023.

Liddell grew up in furniture retail, became a sales rep and then a

manufacturing executive. An astute observer of the furniture industry in his

own right, he prepared his comments after surveying retailers in trading areas

across the country.

He began his remarks by addressing a number of major concerns for home

furnishings retailers in 2023. At or near the top, for most, are concerns

about current inventory levels

The First Loss is the Best

“Retailers couldn’t get it, so they bought more. It wasn’t

necessarily the right product. They paid too much, and the freight rates made

everything much worse.”

“Now that business has slowed at retail,” Liddell observed,

“Murphy’s law has kicked in. To compound the problem, a surge of

late product being shipped to retailers has loaded credit lines and caused

continuing cash flow problems.

“The important thing here,” He noted, is to do whatever it takes

to move this inventory out quickly. The first loss is the best loss in many

cases. Instead of big discounts, try doubling commission rates or adding a big

SPIFF. This will motivate your salespeople to sell more. It’s a good way

to kill two birds with one stone. Instead of giving huge discounts to

customers, your salespeople will get an incentive to perform well during a

time of reduced traffic. Doing this will also serve as a powerful retention

tool.

“Consumers love to feel like they’re taking advantage of retailers

forced to offer big and legitimate discounts. That’s why when you do

choose to discount prices to offload excess inventory, it’s a good

policy to tell shoppers the truth about your situation. Let them know that you

are overloaded with inventory and the reasons why.”

Lots to Say About Cash

Liddell had a lot to say about cash flow and financial issues. “More

furniture retailers,” he explained, “are having trouble paying

their bills than we are being led to believe. Right-sizing inventory will help

not only with cash flow but also save on expenditures for overflow warehouse

space.”

Staffing: “It’s not unusual for us to go into a

store that’s struggling financially and find that it has up to double

the staff needed for current operations. If a retailer’s volume slips,

in addition to right-sizing staffing levels, a major task on their to-do-list

should be to re-evaluate salaries. This is especially important for stores

that are paying above market rates. Having a conversation about salaries is

one thing store owners who are having problems rarely do. There are many

reasons, including loyalty and the difficulty of having this conversation with

long-time and trusted employees.”

Credit lines: “Retailers are having credit line issues.

There are only two major factors providing manufacturers with receivables

financing. And while those factors are supposed to provide specific credit

lines for each manufacturer, in practice they look at a company’s global

credit line. Recently, credit lines have tightened due to the instant,

immediate and unexpected failure of retailers and some manufacturers. An

example is United/Lane, which sent shock waves through the whole

industry.”

Bank Covenants: “As business has slowed, retailers are

using more bank credit lines at significantly higher interest rates to satisfy

cash flow demands. That’s causing banks to take a hard look at the

furniture industry as a high-risk proposition.

“Banks have recently cut off credit lines and called notes for more than

one large retailer. This is similar to what happened in 2008, 2009 and 2010.

Back then, we joked that it was almost as if somebody sent a memo to every

banker warning them about the potential for furniture store failures.

That’s why every retailer who reads this article should review the

covenants in their bank loans to ensure that they are in compliance.”

Creditors: “Retailers need to communicate frequently

with their creditors. Credit managers tell us that their retailer customers

don’t do this effectively. They just go radio silent when things get

tough, the worst possible thing to do. Furniture World readers who are having

cash flow issues need to be honest with suppliers, and only make promises they

are 100 percent sure they can keep.”

Closing Locations: “When cash flow is challenging,

closing a weak store with a professionally run store-closing event can be a

great way to generate significant cash flow. We do that frequently for clients

who have multiple stores. It cuts back on massive amounts of inventory,

generates cash flow and frequently, most importantly, generates

profits.”

“Banks have recently cut off credit lines and called notes...

That’s why every retailer who reads this article should review the

covenants in their bank loans to ensure that they are in compliance.”

Employee Retention

“Recruiting and retaining employees is problem number one for every

retailer out there,” Liddell told Furniture World.

“PFP has closed a number of stores for clients recently, and more are

getting ready to close because of an inability to achieve proper staffing

levels. The latest government reports indicate that approximately seven

million healthy Americans are choosing not to work. They are not getting

government money anymore, so we’re not sure what they are doing with

their time. Fortune magazine just wrote an article noting that in 2022, one in

eight millennials, the oldest of which are turning 41 this year, moved home to

live with their parents.

“Retailers need to do even more to attract and keep employees.”

Liddell related a number of tools retailers are using to achieve this end.

Perks & Benefits: “Over the past few years,”

he observed, “employees have seen tech industry giants giving countless

perks and benefits. For example, six weeks of paternity leave for new fathers

plus four to six weeks of paid vacation. How can any retailer compete with

that? Some have tried giving sign-on bonuses, paid after a period set by the

retailer. Others have switched to paying a commission on written versus

delivered. It’s not a new idea, but it can be helpful.”

Creative Compensation: “Others,” he said,

“have offered creative compensation packages to provide commissioned

salespeople with more consistent income streams. This helps job candidates

overcome fear of the peaks and valleys often associated with

commissioned-based positions. One retailer I recently spoke to pays his

salespeople a flat amount each week and settles up on their earned commissions

at the end of the month—a pretty smart idea. That same retailer noted

that his people absolutely love it.”

Frequent Gratification: “More ideas? Try profit

sharing. Retailers who do this are often shocked by the positive results.

It’s important not to make goals impossible to reach or have employees

wait too long to get paid. Build in frequent gratification. Monthly or

quarterly bonuses or profit distributions work best to maintain loyalty. These

distributions don’t need to be large. At a minimum, profit sharing gives

employees the feeling that they have an important stake in a company and that

the role they play is more than just a job.”

Recognition: “Gone is the time when employees could

receive a quick training session and be on their way to perform at an expected

high level. Continued training, awards programs, confidence-inspiring sessions

and finding ways to keep morale high during slow periods are critical to

retention. For example, taking a different team member out each week for a

special lunch shows them that they are valued. When doing a sale, we

frequently treat entire sales and warehouse teams to lunch or dinner to

recognize stand-out employees. Another idea is for owners or managers to hand

out gift cards to top performers. Do this while they’re working with a

customer. It acknowledges their professionalism. Just walk into the middle of

a sales presentation, introduce yourself and say, ‘I don’t want to

interrupt, but Jane has done such a good job of serving her customers that I

am giving her this gift card to show our appreciation.’ After handing

Jane the card, say, ‘I trust that you will be able to help this customer

find exactly what she needs as well.’ Then walk away. In short, let your

team members know they are important to your business and that you can’t

do it without them.”

Mature Shoppers

“About a year ago, I asked one of our clients in North Carolina how old

his average customer is,” Liddell recalled. “The retailer replied

that it looked like they were some place between crutches and a walker!

“Since then, I’ve asked all my clients the same question. Many

smaller, independent retailers say, ‘Oh my gosh, so old.’ Younger

shoppers aren’t showing up because they don’t believe these stores

have anything they are looking for. ‘It’s mom and dad’s

store, not mine,’ they tell themselves.

“These same retailers are proud their brand has survived for 50, 70 or

100 years in the furniture industry, but this longevity is a liability if

their model is tired, or if younger shoppers believe it is. At this point, it

can be too late to throw advertising dollars at the problem. The best option

for them, other than accepting continued decline, is to implode their existing

model. It’s a tough pill for store owners to swallow. Often, we

recommend that they close down completely with the help of a store closing

sale, then reopen under a new model with a new brand and a concept

that’s fresh and exciting.”

Furniture World asked Liddell if many of them took this advice. He replied,

“Very few, but the ones who do tend to be very successful.

“When considering this option, owners need to get out of their

bubble—leave their stores and travel beyond their familiar trading

areas. We give them names of owners to visit who have developed retailing

models that are relevant to a younger shopper, new, hip and fresh. Only in

this way can they develop a concept that’s unique and exclusive to their

market.

“It’s very difficult or impossible for independent retailers to

compete with the big chain stores anyway. So rather than trying, it makes

sense to offer something totally different. That often means becoming style

oriented and heavily accessorized with fresh, relevant accessories that appeal

to today’s consumer. Retailers have succeeded by creating destinations

that female furniture shoppers take their friends to visit, not just go to

themselves.”

Operations Ideas For 2023

“Retailers who have not done so should set up performance teams for

delivery and warehousing, use metrics and institute weekly reward

systems,” Liddell advised. “They should shuffle their teams to

keep it fair. In other words, if one team comes out on top every single week,

shuffling teams will keep it equitable.

“Many of our friends in the industry have hired contract carriers to

handle their deliveries, which works well. However, retailers should take care

when hiring a company to take over warehouse operations. Our experience is

that when retailers fail, these companies are often owed millions of dollars.

Many warehouse management companies talk a good game, but we’ve found

that the expense isn’t always justified.”

Inflation Weary

Product prices ramped up during the pandemic when deliveries slowed, and

consumers were desperate to furnish their homes. “Now, the promotional

sector of the furniture industry is being hit hardest by inflation,”

Liddell said.

“A promotional sofa used to retail for $299. That’s no longer the

case. Stores that specialize in promotional products have been devastated. My

advice for these stores is to get out of the business of being a promotional

specialist since it’s not getting any easier. We’ve seen these

stores try to adjust their models, but I’ve never seen anyone do it

successfully. That’s because if they’ve done any

advertising—if they’ve screamed price for a

while—that’s all they will ever be known for to the buying public.

As they say, you can’t change the stripes on a zebra.

“Lower income consumers no longer have government-subsidized free money.

And even worse, their dollar won’t go nearly as far as it used to.

Priorities have shifted away from furniture to food and rent as always, plus

the latest, greatest smartphones.”

Compliance Issue Risk

Liddell said that retailers need to watch their compliance on a couple of

fronts, including website ADA and the new tip-over rules. “Everyone

needs to keep an eye on the new tip-over regulation,” he warned.

“Once it goes into effect during the first half of 2023, retailers will

need to make sure that they don’t have non-compliant inventory subject

to the new law in inventory.

“Another issue I’ve heard about from several people has to do with

ADA non-compliant websites. Certain attorneys specialize in finding retail

websites that don’t measure up, then file lawsuits. I’ve been told

that defending against such a lawsuit can cost 80 to 100 thousand dollars.

“Similarly, retailers need to make sure that their aisles, restroom, and

doors are all ADA compliant. That’s another situation local attorneys

are searching for. They all have a client on standby, willing to file a

lawsuit.”

Discounts and LTL

Moving on to pricing, Liddell said that at wholesale, “the market is

slowly returning to normal levels with pricing coming down along with freight

rates. Many vendors offer significant discounts, especially on slower sellers.

Retailers must remember that lower prices won’t make a weak product sell

better. It’s a better practice to stick with best sellers.”

Beware discounted goods: “Most vendors are completely

doing away with pandemic pricing. Instead, they choose to eat their shipping

costs and take the loss immediately. Those that do this sooner know that they

will move the most product and be more important to retailers. Companies are

vying for United/Lane’s business, but so far, no one company is able to

handle all the mix and volume needs. So, we will see how that affects pricing

going forward.”

LTL invoicing: “LTL freight is a continuing problem. In

some cases, invoices are still going past due before retailers receive their

products. I mentioned the issue in my interview with Furniture World, about a

year ago. We suggest that retailers ask their vendors for help dealing with

this issue. Manufacturers’ logistics departments have the leverage to

negotiate with carriers on behalf of retailers. Even though the retailer is

ultimately paying the freight bill, the freight carrier’s customer is

really the manufacturer.”

“Another thing that should be

of some concern to retailers

is that everybody, and I mean everybody, is getting ready to jump into the furniture business.”

Selling or Closing Stores

“In 2022, we handled events for stores that chose to retire while

business was still good. Some didn’t have a next generation to take over

the business. Others felt that the time was right to get out. Many think that

companies like ours only handle events for financially challenged clients, but

that’s less common than retirement sales or closing an underperforming

store, which again, is a good way to boost cash flow.

“One consideration for retailers thinking of getting out of the business

is that it is very hard to sell an independent furniture store, regardless of

how successful it is. Even when a buyer can be found, they may not pay as much

for a well-positioned store as an owner might earn in a liquidation event.

“It’s my experience,” Liddell continued, “that selling

to employees almost never works. The new owners often have difficulty paying

rent and setting up large credit lines with dozens of vendors. The result is

the original owners get the store back and end up with a greatly diluted

liquidation opportunity. That happens all the time.

“Throughout the pandemic, we saw numerous major bankruptcies that kept

us very busy. Independent store liquidations were much rarer. Owners got a

taste of the PPP bailout money and stores were busy. They chose to stay in

business and work for a couple more years. Right now, we are seeing an uptick

in people looking for exit strategies.”

When asked if some well-positioned retailers will use the slowdown to build

stores and grab market share, Liddell replied, “I don’t think a

lot of retailers will add significantly to their store count in the near term.

Those retailers that opened stores during COVID got hit with a huge dose of

reality in the last 12 months as expanded payroll and the additional debt they

took on has made retail life more difficult. The bottom line is that we

don’t know a lot of companies that are considering expanding at this

point.”

More Competition in 2023

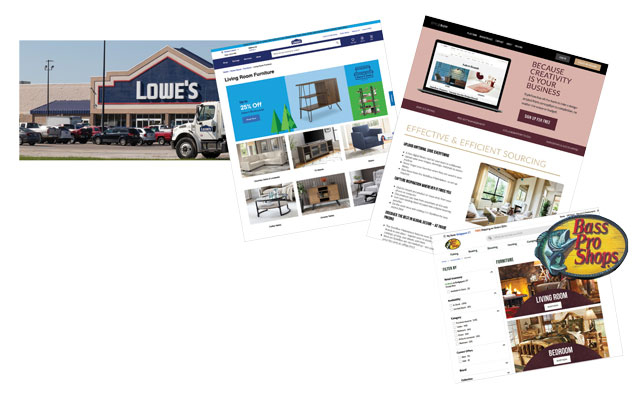

As if furniture retailers didn’t have enough to worry about, Liddell

heaped on concerns about competition from big box stores and online

marketplaces.

“At the time of this interview,” he noted, “consumer

confidence is near an all-time low, and consumer credit usage is near an

all-time high. Savings that consumers built up during the pandemic are being

depleted. Both consumers and retailers are worried about a perfect storm

situation.

“Another thing that should be of some concern to retailers is that

everybody, and I mean everybody, is getting ready to jump into the furniture

business. Lowe’s, Home Depot, Menards, and even Bass Pro Shops, are

featuring expanded furniture options on their websites. Many of the home

improvement players who haven’t done so in the past are starting to

stock furniture in their stores. At first, these stores thought they would

pick up incremental online furniture business. Now they are buying and

stocking.”

Liddell also warned about marketplace companies like Beverly Hills-based

StyleRow (stylerow.com) that provide a number of services to designers,

including product sourcing.

”Basically, StyleRow is a marketplace seller potentially catering to

tens of thousands of designers. This kind of marketplace selling is shaping up

to be a major competitor for retailers because it will turn thousands of

designers who currently purchase from them into direct buyers.

“Many high-end home furnishings manufacturers are jumping at the

opportunity to feature their products on these marketplaces. It’s true

that designers have had the ability to buy product for some time, but now

it’s going to be wide open. What’s interesting about

StyleRow’s revenue model is that they don’t make money selling

home furnishings. Designers pay to be members. Vendors pay to be members.

StyleRow provides a portal for these two groups to come together and do

business. It’s another reason for concern among high end

retailers.”

Winners and Losers in 2023

“The winners,” Liddell concluded, ”will be those retailers

that used PPP bailout money to solidify their financial foundation. The big

chains will continue to benefit from economies of scale, container buying,

high-volume discount pricing and the ability to add new stores with greatly

reduced incremental costs. Frankly, I don’t feel good about ending this

interview by talking about losers. I’m hoping retailers who read this

article will avoid the fate of ending up in that category. As always,

I’m glad to speak with Furniture World readers about any of my comments

in this interview or issues they foresee in 2023. My contact information can

be found at www.pfpnow.com.”

![]()