Interview with Chris Richter

Furniture

recommerce can be a next big thing for furniture retailers who want to

tell sustainable stories, acquire new customers and add income from

returned items.

Although eBay claims on its website that it “pioneered recommerce, the

buying and selling of pre‑owned goods,” the practice is almost as old as

commerce itself. The used car and antiques market, garage sales and

thrift stores all come to mind. And although it’s not a new idea, it has

become an interesting and timely trend. A recent report out of

Wharton/First Insight found that 83% of consumers across all generations

will continue to purchase secondhand products compared to only 17% in

2019. Projections are that U.S. resale is set to grow more than 150

percent to top $330 billion by 2030.

Furniture World spoke about recommerce with Chris Richter, who along

with Ryan Matthews, founded FloorFound, a company that provides a way

for furniture retailers to resell returned or used furniture to

consumers.

Building Trust, Making it Easy

Before launching the company, Richter, who has a background in

e-commerce and supply chain logistics, was paying attention to new

online resale marketplaces for furniture, fashion and home furnishings

that matched buyers and sellers. “These,” he said, “included Poshmark

(poshmark.com) and The RealReal (therealreal.com) in the luxury resale

space, as well as Chairish (chairish.com) and 1stdibs (1stdibs.com)

reselling furniture and home décor.

“This group of fast-growing companies,” he continued, “were really

crushing it by catering to consumers looking for unique items and cared

deeply about sustainability.” They offered trusted ways to resell items,

including bulky furniture, that might have previously been offered for

sale on eBay or Craigslist where users were responsible for all the

details of making the sale, packaging, arranging for delivery and

insurance.

“Visiting furniture stores in my home city, Austin, Texas,” he

continued, “I noticed that floor models were being marked down in a

store-specific way without any rhyme or reason. So, my question was,

might there be a way for me to see all the floor model returns from a

retailer like Restoration Hardware without visiting their stores all

over the country?”

Image (at left) was excerpted from the “The e-commerce Opportunity

for Oversized Products” study found at

www.floorfound.com.

Image (at left) was excerpted from the “The e-commerce Opportunity

for Oversized Products” study found at

www.floorfound.com.

One of their warehouse and refurbishment centers is pictured

below.

Problems with Returns

“At the same time,” he added, “click and brick furniture retailers were

getting tens or even hundreds of thousands of returns per year. Bringing

back and reselling all these items in clearance centers was problematic,

especially when reverse logistics were impractical. Ryan and I realized

that this problem could be solved with a solid recommerce strategy for

returns that generates revenue, facilitates new customer acquisition and

achieves other business goals.”

How FloorFound Works

Richter explained the process. “Let’s say that a customer who lives

somewhere in California buys a sofa from an e-commerce website, like

Crate&Barrel.

“Upon receiving the item, this customer decides to return it and calls

the retailer’s customer care line.

“It turns out that the nearest distribution center is too far away from

where the item can be returned to, so the retailer first offers the

customer a discount to keep the item. If the customer refuses, they may

let them keep it for free or offer to haul it off to a landfill rather

than repairing and restocking it.

“As an alternative, FloorFound developed a return logistics model that

takes the request, arranges for pick up via LTL, and brings the item

back to one of 42 warehouse locations or to be retrieved by a

third-party logistics provider and taken to one of their last-mile hubs.

“Software is then used to run an inspection process to determine what,

if anything, is wrong with the item. It could be missing a leg, or have

a scratch, ding, dent or a tear. Items are then priced for resale and

listed online.

“For us, there are a few different ways we can sell returned items. Our

client, Living Spaces, for example, lists returns that aren’t economical

to bring back for in-store resale on a branded Living Spaces site hosted

and managed by FloorFound. One benefit of reselling on a branded channel

is new customer acquisition of people who prefer recommerce, not just

because they get a good deal, but also because they believe in the

virtue of keeping furniture out of landfills.

“Ninety-five percent of the items we get back are perfectly good and

perfectly resellable?. Presently we do light refurbishment but plan to

scale up repair and refurb over the next couple of years.”

Why Don’t More Furniture Retailers Do Recommerce?

Furniture World asked Richter why more furniture retailers haven’t

jumped on the recommerce model. He replied, “Sustainability and

regenerative commerce are trending topics that are not going to fade

away. Eventually, just about every furniture retailer will have to get

onboard in some form or another.

It makes sense for retailers to start to think about the full

lifetime value potential of a piece of furniture that starts with an initial sale and continues through subsequent sales

in the second quality and used marketplace.”

The largest percentage of retail brands that have adopted recommerce do

at least 15 to 30 percent of their volume via e-commerce. They are

committed to sustainable practices and understand that their customers

will respond positively to this program.

“There are lots of other retailers, however, who are afraid of how

branded resale efforts might affect the perception of their brand or

concerned that the practice might cannibalize their sales of new

furniture.

“The experience of Floyd (West Elm, Pottery Barn, etc.) tells a

different story. Floyd found that roughly 25 percent of first-time

shoppers that bought their recommerce offerings came back and purchased

a new item within 30 days. These were primarily customers who hadn’t

purchased from their brand before. Recommerce turned out to be an

excellent opportunity for them to sell to a new kind of customer and

build brand loyalty.”

IKEA Jumps In

IKEA recently announced the extension of the pilot Buy Back & Resell

service would become permanent. That program permits “IKEA Family

Members” to sell their gently used IKEA furniture back to IKEA in

exchange for store credit. Items will be sold in “As Is” areas of IKEA

stores. Although FloorFound is designed to handle returns, it’s easy to

imagine a similar model where higher-end used furniture could be

repurchased by a retailer or used as a trade-in on previously purchased

goods with certain conditions.

“IKEA has become the poster child for this idea,” Richter noted. “A

model like this could be similar to what car dealerships do when they

reach out to customers to buy back cars for resale. Taking back a used

car creates a recommerce opportunity and helps to sell a previous

customer a new car.”

Standing Behind What We Sell

Furniture World asked Richter if furniture recommerce might breathe new

life into the old sales adage that if you buy a quality piece of

furniture it will last a lifetime.

“There is value in the idea that retailers stand behind what they sell,”

Richter agreed. “It makes sense,” he observed, “for them to think about

the full lifetime value potential of a piece of furniture, that starts

with an initial sale and continues through subsequent sales in the

second quality and used marketplace. It’s the start of a circular

economy proposition that increasingly makes sense.

Highlights of 2021 FloorFound Survey

-

Top 3 Present Resale Items: The top three resale

items purchased by Americans last year were: clothing (44%),

furniture (28%) and footwear (22%).

-

Millennial & GenZ Shoppers: Six in 10 (59%)

sometimes or often purchase furniture on Facebook Marketplace—and

that number rises to 70% for millennial and GenZ shoppers (age

18-44).

-

Awareness: While apparel resale models like The

RealReal and Patagonia are making news, the majority of Americans

(59%) remain unaware of these types of circular commerce

initiatives. However, the majority (54%) of shoppers under the age

of 30 are familiar with these resale models, signaling a higher

comfort level among the next generation of consumers.

-

Consumer Interest: Nearly seven in 10 consumers

(68%) are interested in resale programs that provide high-quality

used furniture in good condition at a discount and 89% would think

the same or better of a brand that offered resale items.

“I believe that once larger players follow the lead of IKEA and others

who become established in the recommerce furniture market, the threat

will become obvious to late adopters who lose an additional portion of

the sales pie. Every home furnishings retailer will eventually have to

onboard a version of a program like this, if only as a defensive move.”

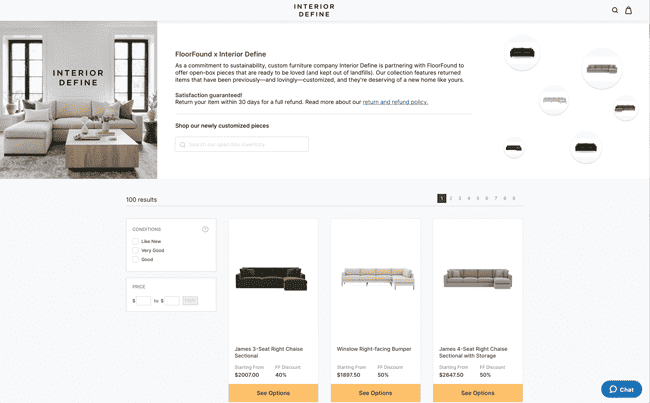

Pictured is a screenshot of Interior Define’s recommerce site,

hosted and managed by FloorFound.

Pictured is a screenshot of Interior Define’s recommerce site,

hosted and managed by FloorFound.

A Few Positioning Ideas

In closing, Richter suggested a few ideas furniture retailers might use

to integrate recommerce programs into their operations.

-

The Story: This is not always a typical clearance

or outlet type of sales story, so retailers need to come up with

different branding positions, such as, “Refresh, Renew or New to

You!” Some story excerpts from FloorFound client recommerce sites

are:

Feather: “Welcome to our Garage Sale! Get savings of 40% or more

on favorite retired pieces. Find dressers, sofas, decor, &

more.”

Burrow: “Here we offer a great deal on our open-box, returned,

refurbished inventory – all of which ships quickly and straight to

your door.”

EQ3: "ReHome allows us to find new homes for gently used pieces

and returns, helping us keep our designs in circulation and out of

landfills. Here, you’ll find timeless pieces to bring into your

home at up to 50% off, so you can feel good knowing you’re doing

right by our planet and your space.”

Mitchel Gold + Bob Williams: Give our heirloom-quality,

handcrafted furniture a new home and get a great deal in the

process with our open box collection. These pieces may be gently

lived-in or spent some time on our showroom floors—but we build

our furniture to last.” Modsy: “Modsy’s returned and imperfect

furniture at up to 60% off! These pieces might have a few

blemishes (think: a scratch here or a chipped edge there), but

they’re perfectly functional.”

-

Save the Sale: Let’s say a customer making an

in-store visit decides that they want to purchase a dining room set

they see on the floor. They say they are moving into a new house in

a couple of weeks. The floor sample is nailed down and it will

likely take nine to 12 weeks to get new stock. Why not offer that

same item located in resale inventory that can be drop-shipped? It’s

a way to potentially save a lost sale.

-

Advanced Segmentation: For those retailers who have a

360-degree profile of their shoppers, recommerce is an opportunity to

target segments that will be open to purchasing second quality

merchandise or re-approach certain shoppers who fail to return to make

a purchase.

Conclusion

Although recommerce isn’t top of mind for many furniture retailers, it

should be. “New resale models represent an important growth opportunity

for oversized retailers and brand manufacturers,“ said Chris Richter.

“So far, consumers are very receptive to resale but largely unaware of

full-scale recommerce programs. Retailers and brands can, and should,

act to implement and promote recommerce initiatives to take market

share, increase revenue, and do their part in protecting the planet.”