RETAIL TREND MERCHANDISE

MICHELLE LAMB ADVISES RETAILERS ABOUT HOME FURNISHINGS DESIGN TRENDS

Trend and design

consultant Michelle Lamb identifies trending styles and colors. She also

discusses how retailers can profit by attending to the allocation of

core & trend merchandise displayed in stores.

For this installment of the Design & Designer series, Furniture World

spoke with Michelle Lamb, co-founder and chairperson of California-based

The Trend Curve. Lamb is well-known in the home furnishings industry as a

home furnishings color and trend forecaster. She has worked with companies

such as, At Home, ACCO, Hunter Douglas, Target Stores, Home Depot,

Walmart, Gerber Baby Products and 3M.

Furniture World asked if it was always her dream to become a trend

observer.

“I’ve always loved retail,” she recalled. “That

was true at my first part-time retail sales job, and it’s true now

that I forecast color trends and design direction for a living. So, in

that regard, yes, I’ve been on this path since the very beginning.

While in college as an English major with a part-time job at

Dayton’s, I planned to pursue a career in publishing. Instead, I was

recruited by Target. And that’s when I really started to dig in.

“There I learned how to do everything from receiving, merchandising

and managing soft goods departments to inventory control. I cut my teeth

in the stores and then moved into buying, first in health and beauty aids,

and then in the home decor department.”

“

A number of retailers that merchandise their stores at good, better

and best price points are selling ‘good’ products in their

outlet spaces.

”

Four years later Lamb was hired as the merchandise and operations manager

for Room & Board stores, then moved back to Target to head up

hardlines trend in their newly formed trend merchandising department.

“After eight years at Target, I worked for Rubbermaid handling

national accounts for just over a year. That job had all the creativity of

plus or minus 10 percent on an Excel sheet. Missing that creativity, I

moved on to co-found Marketing Directions and The Trend Curve.

“The Trend Curve began as a subscriber-based publication. It evolved

into a home furnishings blog as I transitioned to more consulting,

seminars and webinars with a focus on trends, best practices in visual

display and color design.”

Lamb said that pre-COVID she traveled extensively, attending trade shows

in the U.S. and overseas, speaking and developing trend exhibits. When

COVID struck, like everyone else in the trend space, she had to rely more

on intuition. “I found myself reaching deeper for trend direction

than I had in 30 years. And to be honest, I’ve enjoyed it,”

she observed.

“There isn’t a trend out there that doesn’t have its

roots in lifestyle influence. Throughout my career, I’ve developed

trend strategies for retailers and manufacturers, going from macro to

micro. Each trend strategy starts with a 30,000-foot view of what

consumers are thinking and feeling. This translates into behaviors that

affect their wishes and wants for product styles, color palettes,

structures and points of view.”

Retail Trend Analysis

Lamb said that most furniture retailers and brands think that they can do

trend analysis by themselves. “Yet, with all their other

responsibilities,” she observed, “few can devote the kind of

time to trend that it deserves. The consequences of this can impact not

only sales and profits, but also reputation. Now that trend has gone from

being nice-to-know to need-to-know, businesses can’t afford to only

get part of the overall trend story. So, it makes sense for retailers and

manufacturers to tap into the world of trend more deeply by engaging

experts for advice and guidance.

“When furniture retailers look at trends,” she cautioned,

“they should listen to more than just one voice and seek out

commonalities. Doing that will help them to identify the most valid trend

directions. At the same time, they need to remember that nobody knows

their businesses better than they do. There will always be trends out

there that don’t apply to a particular operation.”

Core vs. Trend Assortment

“Every retailer should have core products as well as trend

assortments. These two product areas need to talk to each other. Core and

trend merchandise have different responsibilities and typically, different

profit margin requirements.

“The core assortment includes items customers shop for day in and

day out. It’s what stores are generally known for, and what they are

good at buying. These products are the foundation for everything they do.

Trend assortments include the newest, most exciting and fashion-forward

products.”

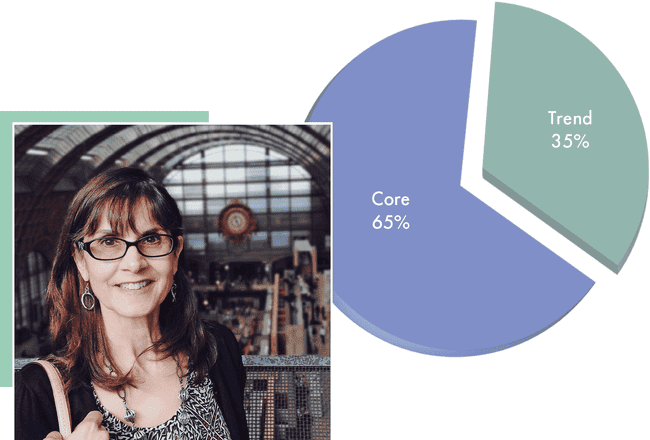

Michelle Lamb says that about 35 percent is a reasonable ceiling

for trend in furniture store assortments. Chart compliments of

Trend Curve.

|

Strategic Trend Plan

“Every retailer needs a strategic plan for how many open-to-buy

dollars and how much floor space to allocate to trend merchandise because

there is risk associated with showing too much or too little.”

Lamb suggested that the first thing retailers should do when planning how

much floor space to allocate to trend merchandise is to determine the

current percentage of products in their core assortment vs. trend goods.

“For retailers who are starting out, or for those who don’t

have much experience with trend merchandise, a good place to start is with

20 or 25 percent of the total assortment devoted to trend,” she

suggested. “See how it works and adjust from there. About 35% is a

reasonable ceiling for trend in furniture assortments. It’s really

easy to add more trend items; it’s not so easy to back out once

you’ve bought in.”

What Customers Know

Furniture World asked Lamb how many shoppers actively seek out furnishings

that are in line with current trends. And, how might retailers skillfully

meet their needs for trend merchandise.

“

The core assortment includes items that customers shop for day in and

day out. It’s what stores are generally known for, what they are

good at buying. It’s the foundation for everything they

do.”

”

“I think you’d be surprised how much consumers know about

trends,” she replied. “Also, how high they think their trend

IQs are.” Let’s say that a shopper visits a store looking for

a trendy pink sofa. It’s my view that sales associates are well

advised to figure out how to bring that color into their customer’s

home without overpowering the space.

“If the color of the year is pink and a customer likes it,

that’s great. Show them the pink sofa. Isn’t it fabulous? Then

let them know that an excellent alternative is to match similarly colored

pink pillows with a toffee colored sofa. There are ways to introduce

trends while respecting what customers know and what they like. They

won’t be satisfied with their furniture purchase or your store if

they end up living in homes filled with colors that don’t resonate

for them.”

Comfort & Color Trends

On the topic of what trends retailers should be thinking about, Lamb

advised Furniture World readers to think about comfort. “Comfort is

a macro trend—one that can be seen from a 30,000-foot-high

perspective as a reaction to the pandemic. Specific retail initiatives to

address this trend might focus on cushion comfort, warm lighting

temperature and warm color palettes. The trend right now is toward

slightly complex mid-tones that are evocative of natural hues. These

include leafy greens, berry-influenced reds, autumnal ambers and golds.

These colors are digging in for the long term.

“As an anchor to those natural hues, we see all kinds of browns.

Many people cringe at the thought of going back toward brown, but they

will become accustomed to browns as these colors advance. I remember a

similar reaction when I first forecasted gray many years ago. Now that

gray has completed a robust trend cycle and moved into the core, it

deserves a rest. Consumers’ eyes are beginning to crave a break from

gray, which is why we’re seeing its sales diminish as browns rise.

These browns might be chocolate, but also anything from taupe to paper

bag. Especially in the middle values, browns are gathering momentum.

More trends crest and plateau

rather than peak and fall off. That’s the case with

grandmillennial that incorporates furnishings that look like they came

from your grandmother’s attic. ”

“Part of this trend is cyclical. We’ve been on the cool side

of color for a while, but now consumers are finding that the warm side is

more comforting. The pandemic has accelerated the desire for comfort and

warmth.”

Texture

“The more natural the texture, the better. We’re tracking

textures that look like papier-mâché and eucalyptus paper,

for example. Also, we see a nice return for chenille and especially

bouclé. Will they boot velvet out of the spotlight? It could

happen. Reactive glazes, relief on glass, and matte porcelain and ceramic

are trending. Marble has a lot of visual texture, but right now it’s

also being given additional texture with new chiseled effects.”

Decorative Looks

Grandmillennial: “Minimalist forms and patterns have been around for

so long that it’s time for decorative looks to come back.

That’s happening in a trend called grandmillennial. This style

incorporates furnishings that look like they came from your

grandmother’s attic, accented with forms that are cleaner and less

detailed. These more-contemporary accents often lean toward mid-century

modern, a millennial favorite for so long that it is now considered a home

furnishings basic.

Vintage with a twist, the grandmillennial trend is well expressed

by the floral patterns of the Twiggy Brown & Blush wallpaper,

a collaboration between Woodchip & Magnolia and Fearne Cotton.

The Simone Screen and Isabella Pouf from Koket (far left) combine

feelings of vintage and glamour in this grandmillennial styled

room.

|

“The trend is all about furnishings that look like or are vintage,

but with a twist. For example, an upholstered chair that your grandmother

loved in tapestry might be recovered for a 21st-century consumer in an

updated color of velvet or an oversized repeat, transforming it into

something unique. Or, vintage-look furnishings may appear in a room with

oversized-floral wallpaper. It’s an eclectic look and part of a

return to tradition that we’ve been tracking for more than three

years.”

“Vintage furniture has been out of fashion for long enough that it

now feels fresh. Chairish has published some astonishing numbers about how

many people have purchased vintage products at www.chairish.com.

“Knowing that consumers are embracing vintage should give retailers

the confidence to try it. I don’t want to say that every retailer

should change the majority of their trend assortment to grandmillennial,

but they might show grandmillennial looks as well as Japandi, supernatural

(natural, sustainable, eco-friendly, sometimes with touches of luxe) and

neo-traditional, because you never satisfy your trend customer with just

one choice. Unfortunately, many retailers have not been able to fully

participate in these trends due to current COVID related manufacturing and

supply chain issues.

Neo-traditional Trend: “Millennials who are at an age and a stage

where they are buying homes and starting families are looking for a

decorating style that’s not only different from the mid-mod starter

furnishings of their younger years, but also a little more grown-up. They

feel drawn to the history and stability of classic lines and details. Yet,

having come of age during a surge of contemporary styling, they need those

historical references to be streamlined, modernized, and the materials in

which they are shown to be updated. Think of neo-traditional as a bridge

from contemporary to traditional style.

Japandi Trend: “Japandi blends a rustic Scandinavian sensibility

with Japanese minimalism. It’s as clean as Craftsman but always with

a Japanese spin. It might take the form of a minimalist chair form with a

fabulous faux shearling fabric. The wood can have a light,

Scandinavian-inspired finish, or mimic Shou Sugi Ban, the traditional

Japanese charred wood technique that’s blackened and textural with

woodgrains showing through. Japandi has been around for about a year but

like other important trends, it’s cresting rather than peaking.

Crate & Barrel has a collection and consumers are waiting to see these

products more widely displayed at retail.”

Biophilia

“The term biophilia describes mankind’s attraction to all

things organic,” noted Lamb. “We’re seeing a surge right

now in the use of the word biophilia as it applies to home furnishings.

The convergence of the pandemic, wildfires, droughts and storm disasters

have laid bare for us what happens when we don’t pay attention to

caring for our planet. There’s been a huge increase in houseplant

sales. Target has a terrific houseplant initiative and many other

retailers have jumped in, selling pots and planters.

“In the furniture retailing space the trend has become apparent

through the use of natural materials like hardwoods, a return to bamboo,

grasses, rattan strip and other natural materials that had their last

heyday in the 1970s. The trend is not just limited to materials, however.

Patterns and surface designs that either replicate or are evocative of

natural materials are also on-trend.”

She noted that there’s an associated focus on indoor health.

“For example, Ikea recently announced the introduction of a new IKEA

Home Smart air purifier built into a table.

“Lush greens are already working their way into retail assortments

(H&M Home, Primark in the UK, Typo in the U.S. and Target at the mass

retailing level), and they were everywhere at the recent High Point

furniture market. We’re seeing these wonderful greens, along with

organic patterns that can sometimes be identified as leaves and flowers,

but other times are more abstract, just giving the impression of being

something found in nature.”

Bold Counter-Trend

Neo-traditional is back in a big way. Pictured is the Wing Tip

chair from Caracole and Column Floor Lamp in Black Cerused Oak

from Global Views.

|

When it comes to identifying major trends, it can be easy to leave out

trend options that will attract and energize a wider customer base.

Previously in this interview, Lamb mentioned how the pandemic encouraged

an ongoing trend towards warmth and comfort. “Where there’s a

trend there’s always counter-trend,” she explained. “A

smaller, though a still significant set of people have reacted to the same

stimulus by looking for bold forms, bold colors and a bold point of view.

To appeal to this customer, retailers need to consider pieces with

elements that feel almost exaggerated or give the impression of being

inflated. These same strong components can be contrasted with others that

could be characterized as skinny. This can happen in a single piece (think

bold seating with thin legs) or within an environment (statement

upholstery alongside a trim table).”

Trend Notes

Display: “If a store has display windows, it can present a real

opportunity to send a trend message to shoppers. Trends can also be

presented in display areas seen by shoppers as soon as they enter a store.

These are the two places where consumers look to get cues about a store

and where it lives on the bell curve for trend.

“Recently while doing some trend spotting at a mall in Southern

California I walked past a Crate and Barrel window that featured a chair,

table, and a screen. This little vignette with five items including a lamp

and rug was an education in trend. It’s something that just about

any retailer can do in a window or floor display.”

Partitions: “How long has it been since we’ve seen screens

displayed at retail? Screens are back because when the pandemic began,

people noticed that the same open floor plans that provided a feeling of

spaciousness were not so great for dividing up spaces for schooling, home

office work and crafts. So, we have seen a fabulous return of screens and

room dividers that can help us define smaller spaces.”

On the topic of room dividers, Lamb related the flex room trend in new

home construction. “Before the pandemic, homes that might have

included a home office, extra bedroom or craft room now include

what’s called a flex room. What can you do with that room? Anything

you want or need. We’re also seeing more home builder options for

multi-generational suites that include some sort of a sitting or living

room, bathroom and bedroom area. The homebuilder Lennar reported that

during the pandemic people started buying a version of their multigen

floorplan to separate work from living areas.

“Consumers are partitioning off nooks, such as bay window areas to

create places for private reading or study. They are also looking for twin

beds that can stack or be rearranged to create activity spaces in

bedrooms. And, where children might each have had their own bedrooms,

parents are doubling them up to free up a bedroom to become a

school/play/exercise/craft room.”

Quantitative Trend Analysis

Lamb uses the bell curve as a metaphor for a trend’s life. She

pointed to seven behavioral stages that define each color, style or motif

trend (emerging, incoming, pre-peak, peak, post-peak, outgoing, decline).

These are illustrated in the chart on page 20.

“The life cycle of a trend is part of every presentation I give.

Once retailers identify the stage at which they want to engage with a

trend, other crucial decisions become easier to make. Specifically, the

curve can help them figure out when to bring a trend into their

store’s assortment. Just as important, it can help them determine

when to phase it out. Understood and used wisely, the bell curve is an

important tool for reducing risk.

“Even though certain trends can be popular early on, most furniture

retailers don’t need to jump in at the beginning of a trend cycle

unless that’s what their shoppers are looking for. If not, it may be

best to wait a while. When it comes to trend, timing matters to both sales

and profits.”

Russell Bienenstock is Editor-in-Chief of Furniture World Magazine, founded 1870. Comments can be directed to him at editor@furninfo.com.