Leases on roughly 1.5 billion square feet of retail space will expire this year. That, combined with a high vacancy rate, make it a buyers’ market for home furnishings retailers.

As a furniture store design firm, we have experienced a significant uptick in calls from retailers negotiating new store leases over the past three months. What is driving this sudden explosion of new projects? As shoppers are ready to enjoy their freedoms again post-pandemic, retailers are seeing new market opportunities and finding unbelievable real estate deals.

Leases on roughly 1.5 billion square feet of retail space will expire this year, about 14 percent of the retail market (source: CoStar Group). Retail vacancies are also predicted to increase to a high of 5.6 percent (source: Colliers International) due to continued COVID-19 fallout and ecommerce competition.

Landlords have lowered rents and provided incentives for existing tenants to stay in place. In fact, retail rents are predicted to decline another three percent this year (source: Colliers International). Landlords are providing more incentives as well to attract new tenants. These include longer rent-free periods, covering more tenant improvement costs, a willingness to grant shorter leases, subdivide spaces, and more.

The strain of the pandemic led nearly 16,000 retail stores to close their doors in 2020 (source: Colliers International). Yet the furniture industry has been largely immune to this. Furniture retailers are some of the only stores performing well enough right now to take these spaces.

For example, a furniture client of ours negotiated a great deal to combine two vacant stores in a strip mall into three separate storefront destinations - one for furniture, one for mattresses, and a third for an outlet. Another furniture client was offered free space in a shopping mall if they agreed to pay for the build-out and operating costs. A third client is taking over an anchor tenant’s space in an outdoor shopping mall. The landlord had been paying the anchor tenant not to vacate, and so was highly motivated to secure a new deal.

Slumberland Furniture took over a JCPenney store to become the anchor tenant for Quincy Mall in Illinois.

|

Available space ranges from large department stores to small mall stores and everything in-between. We will take a look at the various store types up-for-grabs, along with the pros and cons of each.

Large Format Stores

These include department stores, home improvement stores, typically 100,000 to 200,000 square feet. Macy’s is closing about 45 stores a year, JCPenney has closed over 150 stores to date, and Sears will have less than 50 stores left by the end of 2021. These closures deeply affect malls where they are anchor tenants.

Landlords have tried to lure furniture retailers to take these spaces, but many of these stores are too big for furniture retailers. Mall owners have rented these spaces out to Amazon and other ecommerce retailers as distribution centers. They’ve also subdivided and turned them into professional and medical offices. None of these solutions, however, help the other retailers who occupy adjacent spaces. That’s why a retail tenant is still the best possible solution.

Pro: Visibility and Traffic. Large department stores tend to be located just off of major highways and thoroughfares, providing excellent visibility from multiple vantage points. They feature large signage on every major face of the building. The mall is a destination in itself and even though traffic overall has decreased, adjacent stores and restaurants help draw people in.

A third client is taking over an anchor tenant’s space in an outdoor shopping mall.

The landlord had been paying the anchor tenant not to vacate, so they were highly motivated to secure a new deal with a furniture retailer.

|

Furniture retailers that consider mall space need to evaluate whether adjacent tenants will attract complementary customers who are likely to shop at their stores. The more aligned they are with these adjacent businesses, the better they will fare.

Pro: Easy to Convert. Anchor tenant spaces—typically square boxes that allow an easy flow of merchandise and circulation—can easily be converted into furniture stores with minimal construction. Dressing rooms, cosmetic cases and perimeter storage areas will need to be demolished, but walkways and dropped ceilings can often be reused.

Some spaces are large enough to be re-purposed as distribution centers. With the cost of warehousing going up, large format store spaces can offer cost-effective solutions. Owners may offer large incentives to attract the right anchor tenants. They may allow new retail tenants to take over leases, or spaces to be bought outright.

Con: Multiple Entrances/Levels. Most department stores operate on two levels with escalators positioned in the center. They usually have an entrance from the interior mall and at least one exterior entrance for each floor. A furniture retailer that re-purposes one of these spaces may need to block off an entrance, for example, to maintain better control of traffic flow, or else set up teams of salespeople on each floor to monitor entrances.

However, furniture retailers can use multiple entrances to their advantage by branding them as, for example, mattress or outlet stores. Exteriors can be challenging. Macy’s stores, for example, have a signature exterior look that may require a large investment to convert.

With five entrances on two levels, it was necessary to rethink the entire shopping experience. FMOK

duplicated their mattress department on both floors so they wouldn’t miss out on critical sales.

|

Example: Furniture Mall of Kansas. FMOK was one of the first to convert an empty Macy’s store into a furniture store. With five entrances on two levels, it was necessary to rethink the entire shopping experience. FMOK duplicated their mattress department on both floors so they wouldn’t miss out on critical sales.

One entrance was converted into a pick-up center and the warehouse area reworked to service it. Another entrance was branded as “Mattress Headquarters.” FMOK negotiated to get permission to add additional signage on the exterior, and use flags to advertise product categories.

Example: Mathis Brothers—Irvine. The category of large-format stores also includes home improvement stores like Lowe’s and Home Depot. These businesses fared well during the pandemic, so fewer of these spaces have become available. They are, however, generally in busy locations with well-supported retail stores nearby.

This was the case with a 160,000 square-foot Lowe’s space that Mathis Brothers took over in Irvine, California. The rectangular shape provided an ideal storefront presence. Multiple entrances allowed for good merchandise flow, and the Lowe’s Garden Center area was an ideal space to create an outdoor patio presentation.

Mathis Brothers had to retain the architectural style of The Market Place outdoor shopping complex in Irvine, California, instead of using their typical branded store exterior.

|

Medium Format Stores

Strip mall stores are

narrower across the

storefront, so retailers do not get as much credit for the stores’ actual size. When the space runs deep, customers are also less

likely to shop the back of the store.

|

These are normally electronic stores, grocery stores and toy stores, typically 35,000 to 100,000 square feet. Electronic stores like Best Buy and Fry’s have been on the decline for years. These stores are typically in prime locations where landlords take a big hit when they sit empty. Grocery stores have performed well during the pandemic, but badly-managed stores that have not stayed competitive with new concept operations such as Whole Foods, Aldi, and Trader Joe’s are still going out of business.

Pro: Size & Configuration. Electronics and grocery stores have the right square footage for the majority of furniture retailers located in major markets. They tend to be square or rectangular, allowing for simple and easy-to-navigate floor layouts. They have good loading dock setups, well-defined single front entrances and open interiors. Most have ample store frontage that provides providing high visibility and branding impact.

Pro: Location. Electronics stores may be located in destination shopping centers that have other anchor tenants such as Target or Walmart. Conversely, grocery stores tend to be in shopping centers that serve as neighborhood hubs surrounded by local service businesses such as beauty salons, dry cleaning and restaurants. They are rarely located next to main highways but are still highly visible from main roads. Whether in a neighborhood or destination shopping center, a space becomes more valuable if it is located near other home goods, hardware, or related stores.

Con: Condition. Grocery store spaces tend to be more run-down. They often require complete interior demolition to remove built-out storage rooms, offices, walk-in coolers, service counters, and kitchen areas. Floor tile that runs throughout is labor-intensive and costly to remove. Dropped ceiling tile systems must be removed as well. Ductwork may need to be replaced, and the structures and roof deck above completely painted out.

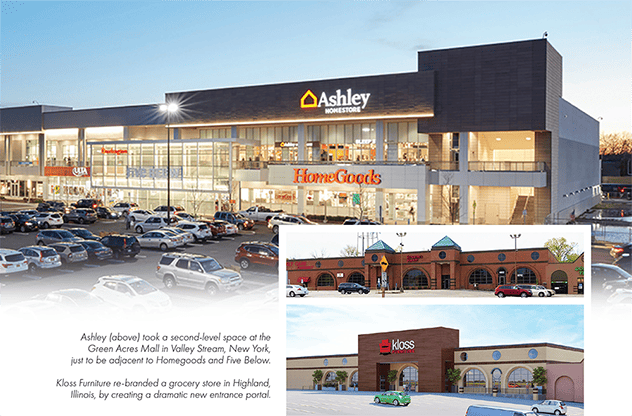

Example: Kloss Furniture. Kloss Furniture negotiated a great deal for a vacant 35,000-square-foot grocery store space. The interior was in poor condition, so a complete gut was required. After taking out the dropped ceilings, Kloss left the space open, repainted the structure above, suspended track lighting throughout, and put down new LVT flooring. This transformed the entire interior space. Kloss gave the exterior a completely new look by converting the main entry into a signature tower and repainting all the existing brick.

Example: Johnny Janosik. A freestanding Best Buy store was easily converted since its interior was already clean and open. Johnny Janosik upgraded it with new track lighting and flooring. The square box shape lent itself to an easy merchandise layout and flow. The exterior posed the biggest challenge, requiring the elimination of the signature Best Buy look. It was converted into a squared-off version at minimal cost.

Johnny Janosik (above left) easily converted a Best Buy Outlet in Christiana, Delaware, into a furniture store. The Furniture

Mall of Kansas (right) converted a Macy’s store to benefit from the visibility and traffic from the West Ridge Mall in Topeka.

|

Small Format Stores

Right now, some landlords are agreeing to revenue

share arrangements for smaller stores in lieu of rent, and are willing to cover most build-out costs.

|

Fashion stores, drug stores and gyms—often 10,000 to 35,000 square feet—were hit hard by the pandemic. There are plenty of these small format spaces available. A surprising number are standalone stores, such as CVS and Gold’s Gym, that provide good independent locations for furniture retailers.

Pro: Condition & Renovation. Stores of this size are suitable for local retailers or for larger operations looking for a smaller footprints in certain markets. They tend to be renovated and in good condition with open ceilings and exposed structure. The store exteriors are often traditionally styled with simple materials and finishes. It makes these stores easy to re-brand, often only requiring repainting and signage updates.

Con: Location & Configuration. Smaller stores may not be highly visible or located in prime traffic areas. Gym locations, in particular, tend to be in strip malls next to grocery stores. More demolition work is required in gyms, which may have specialty workout rooms, locker rooms, and showers. Strip mall stores are narrower across the storefront, so perceived to be smaller than their actual size. Also, when the space runs deep, customers are less likely to shop at the back of the store.

Example: Boulevard Home. Boulevard Home converted a 25,000-square-foot standalone Stage store. They removed dressing rooms and dropped ceilings. The structure and ductwork above was clean, only requiring repainting. The store is set back further from the main street than their other store locations, so there is less visibility. However, the exterior was in great shape so very little investment was needed to upgrade it. They simply added the Boulevard Home signature dark metal paneling to the face along with a new sign.

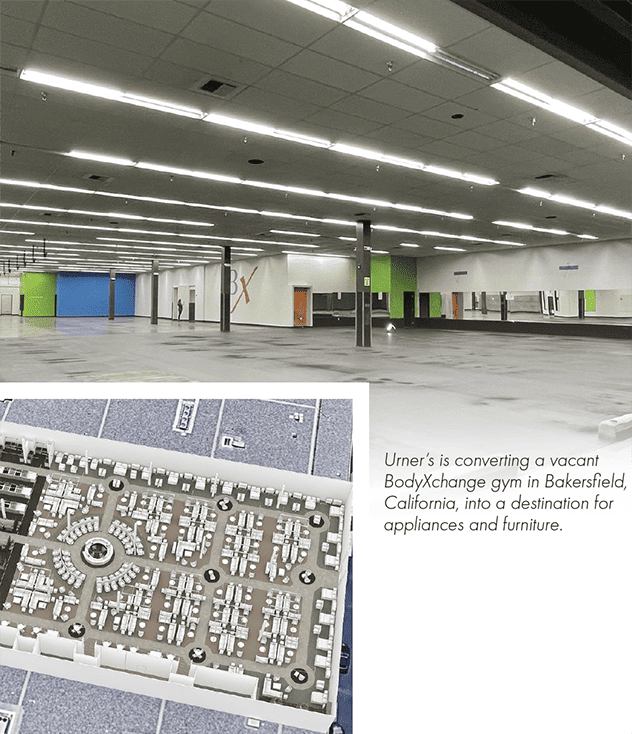

Example: Urner’s. Urner’s is converting a Body Xchange gym located next to a grocery store into a furniture and appliance destination. The exterior requires only a few upgrades and a new sign. The interior space needs a good amount of demolition work, but it is otherwise in excellent condition. The deep, rectangular footprint is harder to work with, but 40 percent of Urner’s products are appliances that they plan to locate as a destination at the back of the store.

Specialty Stores

Specialty stores include mall stores and shopping center stores, usually 1,000 to 10,000 square feet. Also known as inline stores, these are rarely large enough to be used as full-line furniture stores. They can, however, be adapted for a number of different purposes, such as:

-

Outposts to introduce furniture brands to new markets.

-

Single product category stores for mattresses, recliners, outdoor furniture or rugs.

-

Outlet locations.

-

A place to test new or different markets at minimal cost.

-

A place that features selections of “best sellers” for customers to touch and feel—while leveraging in-store access to a website that shows a full range of products.

-

Pop-up spaces that rotate seasonal presentations.

-

Small footprint stores opened in multiple locations to maximize visibility and drive traffic to larger stores.

Right now, some landlords will agree to revenue-share arrangements for smaller stores in lieu of rent, and are willing to cover most build-out costs. They may be flexible regarding short-term leases. These spaces, although not often sought out by furniture retailers, provide an interesting business opportunity.

Example: Mathis Sleep Center. Mathis Brothers was offered a prime 3,500- square-foot space within a well-known mall in Oklahoma City at an attractive price. The landlord wanted to attract a high-profile tenant. To sweeten the deal Mathis was allowed to alter the exterior of the mall to display Mathis Sleep Center branding.

Mathis will use this location to focus on mattresses. Their typical Sleep Center stores run from 7,000 to 12,000 square feet, so this is a substantial downsize. There will be a limited selection of 22 beds; enough for most customers to find one they like. If not, they can visit one of Mathis Brothers’ larger stores.

What to Ask For

As a home furnishings retailer in the market for new showroom space right now, you have lots of negotiating power, right now, so request:

-

Significantly reduced rent, deferred rent or revenue-share opportunities.

-

Scaled-up signage and exterior branding that exceeds what is often allowed for “anchor tenant” retail spaces.

-

To raise the height of the store’s parapet to get more visibility and a more imposing physical presence.

-

An extended rent-free period for longer build-out schedules.

-

More significant upgrades to the existing structure. For example, ask the landlord to pay for items such as a new entrance, demolition work, restroom upgrades, removal of dropped ceilings, exterior repairs, and more.

What to Look For

With so many retail spaces opening up, furniture retailers can afford to be picky about their next locations.

-

Make sure the store is visible from main roads, simple to find, and easy to access.

-

Check out adjacent tenants to determine if their target customers are complementary to your store.

-

Look for anchor tenant spaces that landlords are highly motivated to fill.

-

Pay attention to the building’s exterior condition to gauge how easily it might be retrofitted to create a new brand image. You do not want to open a new store that reminds people of what was there before.

-

Look for buildings with significant signage opportunities.

-

Seek out landlords who will let you add home category signs to the exterior or wayfinding signs to the pick-up area.

-

Check out interior conditions thoroughly. Make sure that the floor is level and review what the structure and ductwork looks like above any dropped ceilings.

What to Keep in Mind

With the current supply chain issues, make sure you can source enough product to fill a new store. Be aware that construction costs right now are high. The current shortage of workers coupled with pent-up demand for new build-outs has driven up labor costs.

Material and product shortages are also affecting the construction industry. Flooring, lighting and building materials all require longer lead times, so factor this into your timing and budgeting. Otherwise, it’s the perfect time to find that red hot deal you have been waiting for.