Here's what's going on in retail with IP targeting, OTT, mobile ID targeting, programmatic, targeted Facebook and much more.

Furniture World spoke with Phil Callighan, senior account executive at Traverse City, Michigan-based Knorr Marketing, and Chris Hunt, Knorr’s director of digital sales. The agency was established in 1986 by Doug Knorr and its first client was a retail furniture store. Today Knorr is a full-service advertising agency primarily serving independent furniture store clients throughout the U.S. and some internationally.

We asked Callighan and Hunt to explain some of the strategies that retailers should be considering as we get through this pandemic and come out on the other side.

“Many of our clients have shifted towards digital strategies,” said Callighan.

“They are employing a variety of digital techniques to find potential shoppers and encourage them to visit their retail websites and stores. These strategies include IP targeting, OTT, TrueView Videos, social media like Facebook and other mediums to engage customers.”

“Retailers have also shifted to an omnichannel approach,” added Hunt. “The digital paradigm has flipped to focus on technologies that ‘search’ for people in real-time who are actively shopping for furniture and engaging in furniture shopping behaviors. Although Google AdWords still has its place, retailers are finding they don’t need to rely as heavily on it. Knorr’s clients use patented technologies that allow them to do what's called a match back. Using sales data from the same run dates as a campaign—whether it's IP or Facebook or targeted email—they can match back to a customer’s physical address to prove that John Smith at 123 Main Street, who was served ‘X’ number of ads, made a purchase. The omnichannel approach we use has lots of layers—like an artichoke. For example, a direct mail piece sent to a specific geographic location can be reinforced with targeted Facebook ads and IP targeting.”

Digital Strategies Defined

IP TARGETING: “IP targeting, explained Callighan, “matches snail mail addresses with the internet protocol (IP) address in people’s homes. It’s a way to serve primarily digital display ads in various formats to devices such as mobile phones, laptops and tablets.

“Wherever people are trying to access content on search engines such as Bing or Google, when they visit ESPN or FOX News, the websites of local newspapers and broadcast stations or other sites that permit third-party advertising, targeted display ads can be served.”

He elaborated, “Here’s how IP targeting works for identifying new movers. Households that have recently moved are identified through organizations such as the U.S. Post Office, Census Bureau, or mortgage companies. Within 24 hours of a new mover turning on their modem, retailers can capture the IP address that’s attached to the new mover’s physical address. Then retailers can start serving ads to devices within that household and get ‘first crack’ if you will, to get their message in front of these potential new customers before they are inundated with all kinds of advertising, including competitors' ads. Unlike programmatic advertising, IP targeting doesn’t rely on cookies. People don't have to visit a retailer’s website, and marketers don’t need to use geolocation services to target content. A potential problem with geo-fencing is that it targets a radius of about a half-acre around a home, which may result in serving ads to neighbors, guests or the paperboy.”

Unlike programmatic advertising,

IP targeting doesn’t rely on cookies. People don't have to visit a retailer’s website, and marketers don’t need to use geolocation services to target content.

|

Programmatic Advertising: “Our view,” said Phil Callighan, “is that programmatic advertising is a somewhat archaic form of digital advertising. It relies on cookies/pixels to retarget anyone who lands on a retailer’s website by serving them display ads on other third party websites. Or, it relies on a geo-fence and location services to target display ads to any mobile device that shows up in a specified radius. The latter has no way to identify if that consumer/mobile device is actually a potential customer, or someone just walking by.”

Mobile ID Targeting: “With mobile ID targeting,” Chris Hunt explained, “retailers can capture the mobile cellphone IDs of people who are out shopping for furniture in competitors’ stores, in real-time. Retailers can target an exact store perimeter that doesn’t include parking lots or anyone using a mobile device in an adjacent store or roadway. This polygonal modeling technique allows our retail clients to immediately start serving ads to people as soon as they walk into a competitive retailer’s showroom.”

“Using this technology, it’s also possible to determine the last retailer a shopper visited. For example, if a consumer visited competitor A and then went to our client's location, there’s a pretty good probability that person purchased from our client. It’s possible to reinforce that assertion by matching back the captured mobile ID to that person’s physical address. The flip side is if a person visited our client's store first, and then later shops at a competitor’s location, it’s possible to justify that a purchase was made from the competitor.”

Targeted Facebook: “Any retailer can do targeted Facebook boosts that are limited to specifying demographics, zip codes, that kind of thing,” Hunt observed. “But it is also possible to add layers of targeting to reach Facebook users who are interested in home accents, home furnishings and specific categories of furniture. This is accomplished by tracking the IP addresses of people who are searching furniture store websites or are engaging with home furnishings related content on social media platforms. Once a person is identified as a furniture intender, ads can be served within their Facebook profile.”

Targeted Email: “Lastly,” Hunt explained, “targeted email can be sent to people who have double opted-in to receive promotional material about home furnishings and home furnishings sales-related topics. These potential customers, who may never have opted-in to our retail client’s email lists, can be identified by their IP addresses through data-mining techniques. Once harvested, the retailer can send them targeted emails. Postal files for these people can also be obtained to send direct mail pieces to physical addresses. This is not spam because retailers do not receive a list of emails that they add to their existing database. Once the person’s email is acquired, they are sent a second email that asks them to confirm their email address and to agree to receive ‘promotional’ emails. They are also asked what kind of promotional material they are interested in receiving. The list is scrubbed every 30 days to give consumers ample time to unsubscribe. Inactive emails are polled to see if recipients still want to continue to receive emails.”

“All of the above techniques can be used to create a robust digital database. The collected data can also be leveraged through direct mail pieces. So, a retailer can send someone who has been identified as looking for furniture an email for a Fourth of July sale. Then, a couple of days later, a direct mail piece can be sent to that same person to remind her about the event and provide an incentive such as discount to drive traffic.”

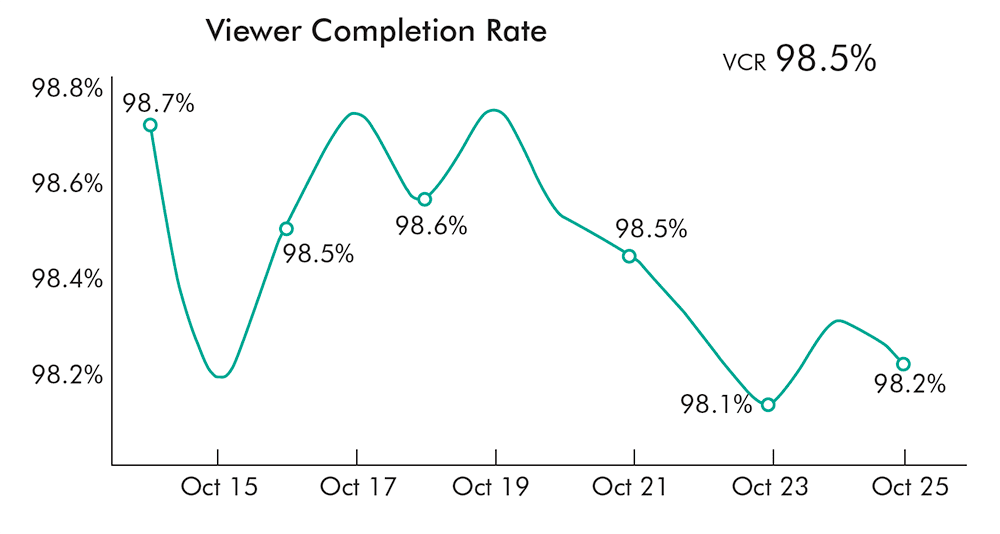

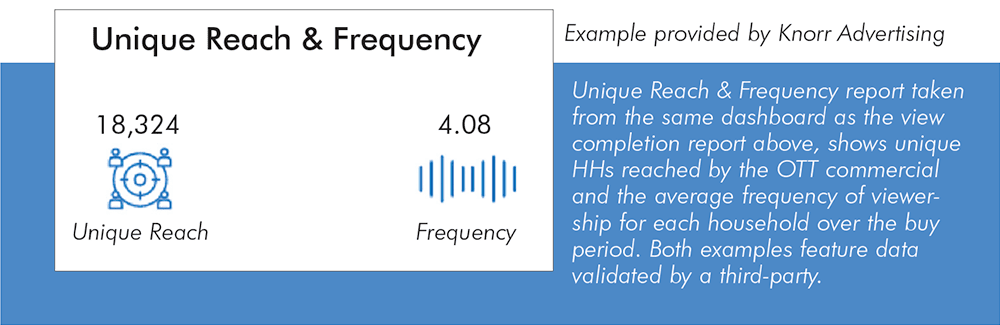

Viewer Completion Rate report (above) comes from a Dashboard showing the viewer completion rate (VCR) for an OTT commercial. VCRs of 95 percent or greater are common if OTT is

purchased strategically. Data provided by Knorr Advertising.

|

OTT Advertising: Phil Callighan, who joined the agency in 1993, started out specifying traditional media such as direct mail, newspaper inserts, radio, billboards and linear television. However he now encourages many clients to run video commercials using OTT, also known as “Over The Top,” advertising to augment or replace linear TV advertising. OTT refers to the delivery of commercials via streaming video content directly over the Internet to an Internet-enabled device like a SmartTV, laptop, tablet, or phone.

“OTT,” explained Callighan, “is very much like regular TV but it enables many of the same targeting and delivery metrics as digital media. In many respects OTT represents the blending of what's best with TV commercials and digital delivery methods.”

According to Nielsen’s latest “Total Audience Report” published in August 2020, “streaming increased from 19 percent in the fourth quarter of 2019 to 25 percent in the second quarter of 2020. Streaming accounted for one-fourth of total television usage among streaming capable homes—which was up about 16 percent from the year prior.”

And, in February 2021 eMarketer reported that they “previously estimated that the number of TV viewers ages 18 and older would increase by about 10 million throughout the year. Instead, cord-cutting unexpectedly accelerated, viewership declined by roughly 10 million, and 2020 ended up with 20 million fewer adults watching (traditional / linear) TV than we thought (landing at 204.2 million). As always, digital video is the leading culprit, rather than any structural pivot away from watching TV-style content in general.”

“Streaming services like Netflix, Amazon Prime Video and Disney Plus,” continued Callighan, “are subscription-based streaming services that are not ad-supported. The streaming pie, so to speak, that does accept advertising accounts for roughly 25 percent of the overall marketplace. And, the amount of time that viewers spend watching these ad-supported content streaming services increased more than 57 percent year-over-year last year.

“When someone purchases a Roku Player or a Fire Stick, they can already access a number of streaming services without having to pay anything more. The use of services like Hulu and Sling are growing fast. The average adult American consumer now watches more than two hours of digital video daily. That figure, of course, accounts for all digital video whether they're watching it on their smartphone, television, laptop, whatever.

“OTT has grown dramatically. FOX owns Tubi, a popular ad-supported streaming service. Comcast owns the XUMO platform, Viacom CBS owns Pluto Streaming, and Dish Satellite Network owns Sling TV. Major media companies have seen that OTT is overcoming traditional/linear TV as a go-to resource for entertainment and episodic programming. The COVID-19 pandemic accelerated this shift.”

“More people are unplugging or cord-cutting cable,” added Hunt. “Today advertisers are at the mercy of when and where people are consuming information. There are lots of choices. All the major networks have streaming services. NBC has Peacock. Discovery has Discovery Plus, which also includes A&E, Food Network and the DIY Network.”

“OTT is very similar to other digital products,” noted Callighan, “in that specific zip codes can be targeted. Stores can get in front of people when they're consuming information on Sling and Pluto, but also via traditional networks like NBC, FOX, CBS, Discovery and A&E. A real difference between OTT or CTV and traditional Broadcast over-the-air TV, is that people who are streaming TV content are less apt to turn a channel when a commercial comes on. That's because they are invested in the content they are watching and want to get to the next segment of the program.”

Pictured is a screenshot of an organic post on Smith Home Furnishings’ Facebook page. Also, a frame from a 30-second OTT commercial produced for Smith Home Furnishings’ “Presidents’ Day Sale” campaign. Images were provided by Knorr Advertising with permission from Smith Home Furnishings.

|

Callighan added that one of the great benefits of OTT is that video commercials served with OTT are non-skippable. Viewers can’t fast forward or disable them. This is quite different from online YouTube TrueView videos where a viewer can often skip a commercial after a few seconds. To add to what Chris said about OTT—these videos can be targeted by zip code and to households within that zip code that fit a customer profile.

OTT targeting options include not only age,

gender and race, but also annual household

income, lifestyle and behavioral characteristics.

|

“Traditional, linear TV requires that retailers buy an entire DMA (Designated Market Area) with program rankings provided by Nielsen surveys. OTT allows retailers to place commercials in specific zip codes within a DMA with greater targeting efficiency. So, for example, a retailer whose store is miles away from a major metro market that may dominate the DMA, can use OTT to target specific zip codes and household profiles that more closely define their local market. Rather than buying the entire DMA, they might target just 20 zip codes in their local area to avoid wasted viewership and expense.

“OTT targeting options include not only age, gender and race, but also annual household income, lifestyle and behavioral characteristics. Retailers can target furniture buyers, but also parents of pre-teens, single-family homeowners, fine diners, or NASCAR fans. There are hundreds of behavioral characteristics that can be targeted with OTT.

“The providers of OTT know a lot about who is watching. When people sign up for either a streaming enabled device such as a SmartTV or ROKU, or a content provider like HULU or SLING, they usually provide a credit card. As is widely known, credit card purchases generate lots of financial and transactional household data available to marketers.

“Another key point to remember about OTT is that when people watch content on a streaming platform, that information is archived, contributing to an ongoing profile that can be targeted by furniture retailers.

“When retailers purchase advertising directly from a cable company or network broadcaster, they specify a day, daypart, channel or program within a DMA. Traditional linear TV advertisers look at targeted gross rating points extrapolated from Nielsen surveys. They select the programs that provide the highest gross rating points among what they consider to be their target audience.

“Unfortunately, linear TV targeting is limited. Age, gender, and race are the limits of targeting you can do with linear TV. A retailer who wants to target women between the ages of 25 and 54 with linear TV will favor programs that surveys say are watched by much of this audience on a specific day, in a specific daypart. The shortcoming is that the surveys can’t tell you where within a DMA all those females 25 to 54 are located. Retailers find that it is more important to reach a much more targeted audience where and whenever they're watching—whether it's TV during prime-time or three o'clock in the morning. This has contributed to the decline of linear TV viewership.

“Let’s compare the efficiency of OTT vs. linear TV for a hypothetical retail furniture store. If a retailer pays $20 per thousand for linear TV inventory in their quest to target moms in households with annual incomes of $100,000 or more, perhaps 10 percent of the households viewing a linear TV program will fit that profile. The retailer is, therefore, paying an effective rate of $200 per thousand to reach those moms and homes with annual household incomes of $100,000 plus. Using OTT at a rate of $50 or $100 per thousand might seem expensive, but since OTT can identify those $100,000+ annual income households with moms within specific zip codes, when compared to paying the effective rate for linear TV, it’s actually a bargain.

“Today, a large retailer might invest 60 to 70 percent of their TV advertising budget on network TV and 20 to 30 percent on OTT to reach those people who no longer watch network linear TV. OTT skews a little bit younger, so more boomers are watching the news on linear TV, but we see both boomers and younger generations watching news and certainly entertainment programs on OTT. Smaller retailers who can't afford to buy an entire DMA or retailers that simply prefer the enhanced targeting available with OTT may invest 100 percent of their broadcast advertising budget in OTT.”

Do traditional radio

and television for very broad stroke messages.

When looking for people who are shopping for a mattress specifically, that's where mobile and IP targeting might come into play.

|

“Unless a retailer has an astronomical advertising budget and always wants to deliver content on Hulu, Sling and Peacock, it makes sense to use a blended approach.”

Advertising Messages

Pivoting to the importance of effective messaging, Chris Hunt noted that, “With targeted digital, there’s so much data available that everything can be monitored, including which creative materials are doing the best job of engaging people to click-through and visit retail websites, what content people are consuming, and where they are consuming it to provide the most engagement. This allows advertisers or ad agencies to pivot in real-time when things aren't working as well as planned.

Advertising Blowtorches

s like direct mail, broadcast television and broadcast radio that best serve as virtual blowtorches. They can deliver massive reach for a branding message, promote a grand opening or a blowout sale in a very short time frame. I would encourage Furniture World readers to do traditional radio and television for very broad stroke messages. When looking for people who are shopping for a mattress specifically, that's where mobile and IP targeting might come into play because it can identify people who are actively searching and shopping for mattresses or showing behaviors of interest in mattresses, effectively allowing retailers to serve ads to that population in real-time.”

Advice for Retailers

“We find that furniture retailers in general could do a better job at leveraging all the data that’s available to them for making advertising decisions,” concludes Hunt. “Independent furniture retailers who find themselves throwing a bunch of stuff at the wall to see what sticks and what doesn’t can benefit from developing some expertise in-house or hiring an outside marketing firm that can map out a customized strategy, craft a message, do the creative, have a robust approach to using data and use targeting to get desired, quantified results!

“Today, Omnichannel marketing is what's most important. It allows smart retailers to squeeze every penny they can out of an advertising budget by using available data to provide better targeting, more useful analytics and maximum effectiveness.”

Russell Bienenstock is Editor-in-Chief of Furniture World Magazine, founded 1870. Comments can be directed to him at editor@furninfo.com.