It’s the most important asset in any furniture business

Proper cash levels enable businesses to continue operations. With adequate cash, inventories can be kept at the correct levels, employees can be hired and paid properly, and capital reinvestment becomes possible. Without cash, extra financing is required through delayed vendor payments or loans, and interest is incurred. If levels get too low, vendor shipments are slowed and the businesses may eventually become insolvent.

Cash comes from profit. How the funds are used, ultimately determines the level of liquidity and the ending cash available in your retail business. Well run operations have consistently adequate net income levels. They also have proper budgets to control the levels of major usage accounts: inventory, accounts payable, deposits, and receivables. Well-run firms exhibit high levels of stability - in ALL economies. That allows for self-investment, which leads to growth and even greater levels of prosperity.

Alternatively, those operations that don't understand how cash is REALLY accumulated, often experience cash shortages and have higher loan levels. Coincidentally, these operations are often the ones that have very tight expense controls and loose balance sheet controls at the same time. Well run operations can afford to spend money BECAUSE they are well run.

Poorly managed retailers just can't afford it. Many that are profitable on their P&L's due to being excruciatingly frugal, are unguided when it comes to inventory, payables, and deposits/ receivables. This is a situation that can lead some profitable companies to become insolvent and be forced ultimately into bankruptcy.

If you feel in the dark at times as to why your cash is at the level it is, this article is for you. Here, I build upon a case scenario that was featured in the previous 2 issues of Furniture World. You can read those online at www.furninfo.com.

To start, here is a simplified equation for cash:

Beginning cash plus profits, minus increase in assets, minus decrease in liabilities financing = ending cash.

So what would happen to cash if: net income was $100,000 and inventory went up by $50,000 and AP went up by $75,000?

Profit brings in $100k cash, inventory uses $50K, and there was a supplier loan increase of $75k. Cash would have gone up by $125,000.

Wouldn't it be great if you could see this information clearly every month and even project into the future? Well, if you have proper financial statements and know how to use them, you already have this information. It is your most important management report. It is your Statement of Cash Flow.

I'm often curious. Why do many business owners avoid their most important management report? The only answers that I can come up with are that either they don't have the proper monthly financial reporting procedures or that they simply don't understand it. And, if they don't understand it, they can't have a properly functioning financial system. The third, kind of scary answer, is that they don't believe the Statement of Cash Flow is important.

If you are reading this article, you care. You can become a cash flow expert.

In an effort to increase knowledge of how to use a Statement of Cash Flow, let's consider the following scenario:

Cast Study: Furniture Company Background

- Family owned and operated.

- Full line furniture, no electronics, or appliances.

- One store operation with one detached warehouse.

- Family owns buildings separately and business pays rent.

- 25,000 square foot showroom.

- Eight salespeople, one sales manager.

- Average sale = $1,350; traffic count for 2011 = 18,519; close rate = 20%.

- $1,000,000 average inventory at cost.

- Vendor merchandising – mid to upper end.

- Special order percentage = 50%.

- Budgeted sales for 2011 = $5.26 Million.

- 2011 Sales = $5,000,000.

- 2011 Cost of Goods Sold = $2,800,000 @ 56%.

- 2011 Gross Margin = $2,200,000 @ 44%.

- 2011 Net Income After Interest and Tax = $52,000 @ 1.04%.

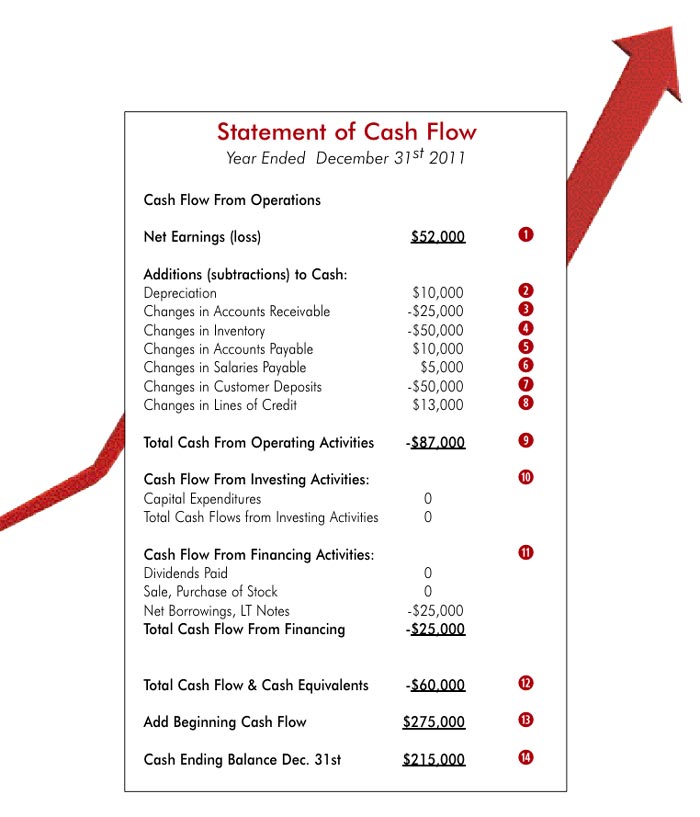

Cash Flow chart Notes Refer to Statement of Cash

Notes below refer to the red circled numbers in the Cash Flow Table above.

(1) Net income: Inflow of cash for this retailer is $52,000. It had $5 million in sales, 44% Gross Margin, approximately 42% in operating costs, and the net income after tax as a percent of sales was 1.04% (For more detail, refer to the first part in this series, “In-Depth P&L Analysis” published in the January /February 2012 issue of Furniture World, posted to www.furninfo.com under “Magazine Articles”. This retailer only has $52,000 going into cash flow from profit. This alone does not determine the ending cash flow. Transactions that are not sales and expense related now come into play.

(2) Depreciation: In addition to profit and loss activity, other regular business operating activities affect whether cash goes up or down. These non P&L activities occur on the balance sheet (Refer to the second part in this series, “Think Profit- Your Balance Sheet,” published in the March/April 2012 issue of Furniture World, posted to www.furninfo.com under “Magazine Articles”. They affect cash flow just the same. The first one, depreciation, is listed as an addition to cash purely because it was already recorded as a reduction against net income (and it really did not affect cash as it is a non-cash expense). In this example, a $10,000 addition to cash is recorded due to depreciation. A side note here: it is a better practice to keep up with your depreciation schedule on a monthly basis rather than in one chunk at the end of the year to get a better idea of your profitability throughout the year.

(3) Changes in receivables: Outflow $25,000 cash. Cash went down because receivables increased during the year. In other words, they lent customers a net of $25,000 rather than collecting at the time of the delivered sale.

(4) Changes in inventory: Outflow $50,000 cash. They ended up carrying $50,000 more in inventory during the period. Inventory has important effects on cash, seen on both the balance sheet in terms of purchases, and on the income statement in terms of carrying costs. You can’t live with it and you can’t live without it. This firm has a 20% inventory to sales ratio. This is too much considering they were short of their sales plan. Highly profitable firms in their industry sector have 15% inventory to sales.

(5) Changes to accounts payable: Inflow of cash $10,000. Consider payables as a short term (often interest free) trade loan. If you hold more payables, you have a larger loan since you have paid out less cash. The trick here is to find your balance between getting this interest free loan, considering the value of taking any trade discounts, and avoiding becoming late on accounts that could affect your services, credit rating, or inventory flow. (There is a system for that, but that is another article).

(6) Changes in Salaries payable: Inflow of cash $5,000. This company brought on a couple of new employees at the end of the year causing salaries owing to increase for the prior year final period. In other words - they have a temporary employee loan.

(7) Changes in Customer deposits: Outflow $50,000 cash. They took in fewer deposits on special order sales. This figure is a concern and should be investigated. Was the decrease in deposits due to a decrease in written sales? Was it due to salespeople not following the policy of asking for full payment and getting a 50% deposit minimum? Or, was it from a decline in special order sales vs. sales from stock. Whatever the reasons, wouldn't you want to know why, if it were your business?

(8) Changes in Line of Credit: Inflow of cash $13,000. Ok, I'll throw this out there now: not all reasons for additions to cash are good reasons. Store management decided to dig into their LOC at the end of the year to fund a new container shipment. Their LOC loan went up resulting in a cash increase. It could be good or it could not be good depending on the situation and the reason. Since this retailer is over-inventoried, it clearly should not have invested in new, untested merchandise shipments which could result in ongoing cash flow shortfalls.

(9) Total cash flows from operating activities: Outflow $87,000 cash. So here we have the case of a profitable company actually losing money! By looking only at the P&L, an uninformed analyst could draw the conclusion that they are breaking even so - no worries on the cash side. By looking only at the balance sheet, an uniformed analyst may conclude that they have a decent cash balance so - they are good. But by looking at the statement of cash flow, where both the results of the P&L and the Balance Sheet are reflected, the informed analyst can provide the proper advice - they have a cash burn rather than earn. It’s a situation that can be of concern or not, depending on the reasons.

(10) Cash flow from investing activities: No cash flow effect. Investing activities are different than operating activities as they typically take the form of capital expenditures and longer term fixed asset purchases. For example, if the company were to purchase new equipment or machinery for its distribution center, the value of that equipment purchase would cause a cash decrease. If the reinvestment is for business improvements, the goal is to gain a greater return on the investment and a subsequent increase in cash flow in regular operating income. So, reinvestments are key to developing innovations for new revenue streams or increases in efficiencies. This company did not engage in any investing activities during 2011.

(11) Cash flow from financing activities: The outflow is $25,000 cash. Financing activities are the last category, after operating and investing activities, in the cash flow statement. In this section we can observe cash effects due to activities that support the long term funding of a business, as well as any effects of the sale of company stock or payment of dividends. In this scenario, the only effect was due to a decrease in the long term note on the business.

(12) Change in cash flow: Outflow of $60,000. This is the net cash flow result for 2011. Again, even though this retailer made $52,000 from sales and expenses, it lost $60,000 in cash. That's a $112,000 difference. If the cash had been spent as an appropriate reinvestment with a plan, that might be ok. But here in this scenario, presented in this three article series, I fear that this operation did not have the knowledge or pay adequate attention to developing strategies based on a careful review of its balance sheet and key performance indicators (KPI).

(13) Beginning cash: Cash at the start of the period was $275,000.

(14) Ending cash: Cash at the end of the period is $215,000. ($275,00 - $60,000).

Conclusion & Recommendation

This detailed case study is based on a retail furniture company I worked with closely. This operation was in fairly rough shape, but was able to refocus on improving their business. Today they are approaching double digit net income, are hitting their sales goals, and are managing their inventory supply chain professionally.

Here are three core observation points and a few key recommendations that were given to them prior to their turn around.

Observations:

- Sales goals were missed due to a variety of sales management issues.

- Inventory levels were too high for the sales volume.

- Gross margin was underperforming.

Recommendations:

- Establish a professional financial budget and pro forma to act as the business plan and strategy guide (pro formas and budgets are basically projected financial statements with set actions to achieve desired results).

- Hire and properly train 2 or 3 new salespeople.

- Improve the effectiveness of the customer relationship management system (CRM). Manage it.

- Focus on better customer follow up. Track it.

- Increase average sale through fabric protection programs. Track it.

- Improve inventory management systems and closely watch key performance indicators.

- Establish open to buy guidelines for purchases of new merchandise.

- Make sure to price special orders and best sellers appropriately.

- Proper price pointing.

- Religious execution of mark down strategy to identify and sell dead merchandise.

Final Result

Oh - you might ask how much this company’s profits and cash flow increased as a result of these changes.

Great question. The projected results for 2012 are a 477% increase in profitability. They are on target for an after tax net income increase of $248,000. Cash flow is forecasted to increase by 137% to $513,000 from $215,000 by Dec. 31, 2012. And that is why it is essential to take action based on a careful review of your three major financial statements.