Part 4- Excess inventory creates a web of undesired consequences.

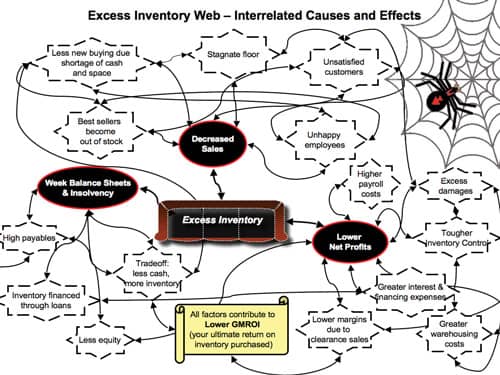

Carrying too much inventory creates a host of web-like cost effects in your business. If you get caught in this web, it will slow down your business and result in a sticky situation that will be difficult to escape from. You could become immobilized, just like a fly staring into the eyes of a spider, waiting to get eaten.

You can escape this fate before you become too entangled, or avoid it altogether if you understand the reasons why so many otherwise good companies get caught. Then you can evaluate your current situation, identify and untangle all of the effects that excess merchandise has on your sales, cash, and profitability.

The best retail furniture operations in the world run their businesses continuously at around a 15% inventory to sales ratio. This statistic has been published year after year by the NHFA and has been verified in my own consulting practice. There are no double digit profitability stores that carry over 20% inventory to sales for any extended period of time.

Why is it then, that the majority of home furnishings operations run at much higher levels?

It is common to see stores over 20% and some at even over 30% inventory to sales levels. Store owners and managers fail to take action, because they do not see inventory as a problem. Instead they see it as a solution, believing that they can buy themselves into profitability. Some say, “If we just buy the right merchandise, our sales will increase”.

Then, when sales stay the same or increase slightly and the next furniture market rolls around they say, “I think if we just try this new group; our sales will increase more”. Yes, new buying is necessary, but it should only be done when inventory to sales levels are appropriately lean.

Another misguided idea furniture retailers hang on to is that inventory is an asset with a lot of liquidity. Although inventory is an asset, it is not equal to cash. Cash, with prudent investment, appreciates with time and is liquid. Inventory depreciates and only best sellers are liquid. In fact, smart financiers don’t even consider inventory when looking at the solvency of a business. They look at the quick ratio only. This is the ability to cover short term debt with current assets, excluding inventory and long term receivables.

One final reason why stores carry too much inventory based on their sales volume is that they fail to react quickly when changing business conditions negatively impact their sales.

Over the past few years, the housing market slowdown and the expansion of branded stores have taken a bite out of independent furniture retailers’ profits. Most dealers did not see this coming and continued to buy at the same levels. Many reacted by making cuts in operating expenses when inventory should have been cut first. The minority recognized the slowdown and reacted fast. These are the stores that now maintain high levels of cash flow and respectable profitability, even with declining sales.

If you are an independent store, branded, or a top 100 retailer, the benefits of managing inventory levels are too massive to ignore. Ask the Ashley Furniture Homestores! This is at the heart of their massive success. Maintaining efficiencies will be the primary factor in your long term survival as well as your success.

Impact on cash, sales, and profit

Getting caught in the excess inventory web has three big negative repercussions. It causes:

• A weak balance sheet, leading to insolvency.

• Lower sales.

• Smaller net profits.

Balance Sheet Impact

High inventory creates a weak balance sheet. A high profit company typically has about 19% of it’s assets in cash and 50% in inventory. An average store has around 12% in cash and 56% in inventory. Companies with too much inventory generally show increased liabilities on their balance sheets that are required to fund the larger payables. These companies require more short and long term loans.

The difference between a high profit and average operation with $10 million in total assets is about $700,000 in extra cash. Another way to look at this solvency effect is via inventory’s relation to sales. An operation doing $10 million in sales running at 15% rather than 20% carries $500,000 less in inventory.

Sales Impact

Excess inventory causes sales to drop. There are many factors that participate to create this affect. A major one is the increase in best seller out of stock days. High inventory ties up funds and reduces liquidity. As a result, fewer dollars are available to properly buy your best selling items. Since these items account for the majority of your sales, when you run out... you lose. See parts one and two of this series (posted to the article archives on furninfo.com) for a more in-depth discussion of managing best sellers, and dogs. Nothing is more frustrating than not being able to order a container of your best selling goods because you have to make payroll or your current payables.

As well as not being able to purchase sufficient top merchandise, your floor will become stale, your existing merchandise will become old, and the showroom will become stagnant and clogged with dogs.

This causes a decline in another important measure: customer satisfaction. If you are not able to provide what your customers want, when they want it, they will stop buying and will adopt a negative perception of your store brand. Worst of all, they will tell their family and friends. Your store will appear unfashionable and you will need to invest in higher levels of advertising to generate adequate traffic.

A stagnant floor also negatively affects the morale of your sales force. They, just like customers, love the latest and the greatest. If you allow merchandise to sit, they will sit too. Motivation is the highest at fast moving, dynamic stores.

Think of clothing retailers who take action to recognize and move old stock out immediately. Competition is fierce, inventory is kept correct, customer service rules, and the best systems and procedures are implemented. The thought of being unstylish and old is not acceptable.

Profit Impact

Too much inventory results in a lower gross margin. If dogs are not recognized fast and moved out, they accumulate and overwhelm your systems. This is why many operations hold semi-annual clearance sales, tent sales, and going out of business type promotions. Prices are slashed on a massive scale. GMROI is destroyed due to lower gross margin and slower turns. High profit and average stores are usually separated by three to five points in GM% for this reason.

Significant extra operating expenses are incurred as well. The following is a real example of the gain in profitability that was experienced by a store that decreased its’ inventory to sales ratio from 25% to 15%:

- Gross Margin: +3%; eliminated excessive markdowns.

- Salaries: +1%; reduced extra people to receive, transfer, inventory control.

- Warehouse: +1%; reduced costs of equipment, supplies, maintenance.

- Customer Service: +.5%; reduced occurrence of damages.

- Occupancy Costs: +2%; eliminated unnecessary additional storage space.

- Interest Expense: +2%; reduced cost of loans needed to finance inventory and pay vendors.

- Net Income Effect: +9.5%

The most profitable store that I have visited has a 10% inventory to sales. Their net income was 18%!

Unless you are an antique dealer, merchandise does not age like wine. It becomes more and more expensive to carry each day that it sits. Don’t believe that if you hang on to a poor seller long enough, someone will buy it and you will get your margin out of it. Realize that this product takes up valuable floor space. Your GMROI will improve by embracing a strategy of turning items faster replacing them with best sellers and new items sooner.

Whatever your situation, remember; don’t stop buying your best sellers and special order merchandise, because that is your lifeblood. Controlling new purchases, along with other strategies will help you avoid and even escape the spider web.

In the next issue of FURNITURE WORLD we will provide some strategies used to get your inventory down to 15% and maintain it there.

David McMahon is a Senior Business Consultant for PROFITsystems, Inc. PROFITsystems delivers a "Total Success System" through PROFIT professional, PROFITconsulting, PROFITgroups, PROFITuniversity, PROFITfreight, and PROFITservices. These business units offer best-practice solutions designed to maximize cash flow and profitability. Questions can be sent to David care of FURNITURE WORLD at davidm@furninfo.com.