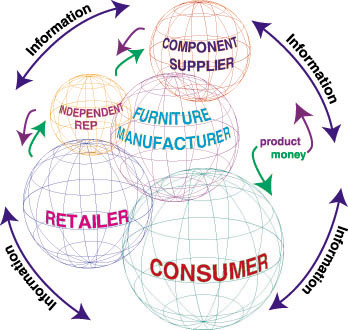

The center of power in the furniture industry is shifting. Now is the time to re-evaluate your position in the New Value Chain.

Editor's Note:

Editor's Note: The first two portions of this article published in the October/November and December/January issues of FURNITURE WORLD (posted to the marketing management index of www.furninfo.com) discussed the emergence of a "New Value Chain" in the home furnishings industry. A value chain, is a network of organizations and individuals through which products and services flow in one direction and money flows in the other direction. The changes, brought about largely by information technology is causing a power shift in the industry. The implication of these changes, the article points out, is not that brick & mortar business will cease to be a significant channel of distribution, but that they will be challenged by new business paradigms. In this article, Sekar Sundararajan continues his discussion of strategies that furniture retailers, manufacturers and suppliers can use to identify potential problems as well as business opportunities.

Create a responsive & adaptive internal organization

Traditionally, internal sub-systems within each company are organized to respond to the needs of its individual organization. However, internal sub-systems need to be organized to respond not only to the needs of their individual company but also in the context of the value chain. For the company committed to providing value to its customers, collaboration across functions and organizations should become the strategy of first choice.

A thorough analysis of value chains indicates that typically less than 5% of the total response time is made up of value-adding activities. The opportunity for organizations to increase their competitiveness and profitability lies in this white space of non-value-adding activities. Focusing on the impact of the non-value-adding activities on the total response time, provides a clear prioritization of opportunities and alignment of direction to all levels of the organization in the value chain.

A company will need to prepare systematically to profitably participate in the value chain. Successful participation in the value chain as a company strategy will require senior management commitment and widespread organizational belief in the concepts and benefits attributed to the strategy. A sample of the critical techniques that foster the creation of an adaptive organization is listed below:

Use Time Based Costing Methods:

Unlike Standard Costing Systems or Activity Based Cost Systems, the Time Based Costing System (TBC) is a system that takes into account the value of time, and the effect of inevitable bottlenecks on the ability of an organization to perform a task. TBC is founded in the systems approach in the well-known book, "The Goal" (Goldratt, 1984).

Align Performance Measures:

Companies too often fail in translating what could be very effective strategies into profits. They do not have a systematic method, nor the tools to turn corporate strategy into the operational decisions that need to be made at the plant or store level. This practice results in different measures for different functions, leading to misaligned priorities and fragmented decision making. In the fragmented decision-making environment, political expediencies frequently influence decisions. This encourages scorekeeping and results in a lack of trust and cooperation among peers of different functional organizations. It is imperative that managers see a company-wide goal and be measured relative to it.

Differentiate Between Confidential & Open Information:

In the agile environment of tomorrow, knowledge becomes a key competitive advantage. The approach of organizations to knowledge derives from the product-centered view of the past where "everything is secret unless decided otherwise. In the constantly changing world of agile competition and self-reconfiguring virtual organizations, a conscious choice must be made of what knowledge can be shared and with whom. Deciding that all knowledge is to be kept secret makes a company an undesirable partner and leads to the organization being excluded from joint ventures. On the other hand not all the knowledge that the company has can be made available to everyone. On balance, agile companies share more data and knowledge than did mass production companies. The communication revolution and the accompanying pressure of globalization are moving companies from a mind-set that each is a closed system, to an understanding that participating in an open system leads to competitive advantages.

Build Inter-Operable Information Systems:

To be part of a value chain, the company must find ways to make all its information timely, accurate, consistent and understandable. The enabling sub-systems must be organized and empowered in such a way that the work flow processes are aligned and inter-operable. This way they can meet the goals of the value chain, not just local company goals and efficiencies.

Nurture Entrepreneurial Thinking:

The people system supports all business processes. This system enables the creation and development of human capital and fostering of a culture of entrepreneurial thinking and life-long learning. In today's business world opportunities come and go quickly, and may not even be noticed by the executive who has not trained himself to look for them. The business world changes so quickly that the astute executive relies on the eyes and brains of all his workforce to find those innovative opportunities.

Collaborate with other organizations

Increasingly, marketplace challenges cannot be effectively met by isolated changes to specific organizational units, but instead depend critically on the relationship and interdependencies among different organizations. Dealing with the value chain as a single operational unit provides two advantages. The first, more obvious, is to reduce costs. The second, less obvious, is to increase the volume of business for the entire value-providing chain and hence for each company in the chain. To achieve this increase in volume usually requires more coordination and a deeper degree of cooperation than reduction of cost alone.

A critical element of the plan is to realistically judge whether your company has the capability to collaborate. This involves the ability to build and maintain the required level of trust. It is important to think through how willing a targeted partner will be to trust your company, how this trust can be enhanced, and how your company can specifically use this trust to increase your chance of success.

In a typical relationship between the retailer and the manufacturer the manufacturer is dependent on the retailer to provide customer needs information. Very rarely is the point of sale information shared with the manufacturer. The lack of timely and accurate information on consumer needs results in the manufacturer building to forecast and carrying inventory in warehouses. Similarly the retailer is affected when slow delivery, poor ability to respond to changing consumer needs and shopping preferences results in clearance sales and heavy discounting. All of this can be avoided if the retailer and manufacturer can share information and collaborate together to provide their customer a solution rather than try to take the "If you win, I loose" perspective.

It is important that the information, material and financial flows be coordinated effectively in a value providing chain. These flows cut across multiple organizations within a company as well as across companies and industries. This, in turn, increasingly transforms the above challenges into problems of establishing and maintaining efficient flows along product and distribution chains. The recognition of this fact will lead to considerable changes in the way organizations interact with their suppliers and customers.

Making It Work: A CASE STUDY

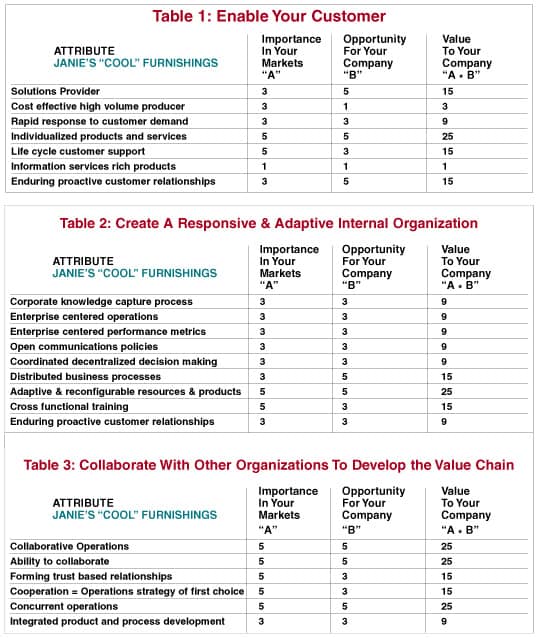

An organization that chooses to look at the possibility of reshaping its value chain and wants to use a quantitative framework for decision making can use matrices similar to those shown in tables 1-3.

- Enabling customers (table 1)

- Creating a responsive and Adaptive Internal Organization (table2)

- Collaborating with other organizations to develop the value chain (table 3)

These tables describe three of the four essential elements that companies need to consider when preparing for the future (fully described in part one of this series October/November FURNITURE WORLD):

This type of approach is very important in today's unforgiving marketplace where wrong decisions (that used to be made primarily based on "gut feel") can critically injure an organization.

The first step in organizing this material is to define important strategic thrust areas. Each area can be thought of as a "corporate need or goal". Next, areas must be broken down into the individual attributes that are the functional elements of that need or goal. These attributes are necessary to realize the previously defined goal. Quantifying each attribute in a matrix can suggest ways that forward thinking companies can prioritize the attributes and develop an action plan.

The process of thinking about this matrix is as important as the result. That's because it forces the company to examine both its corporate culture and external business environment. The process often suggests in counter-intuitive solutions and challenges existing ways of thinking about existing problems.

It is a useful way to put numbers to, and compare qualitative corporate needs and attributes.

Take the case of the hypothetical retailer, Janie's "Cool" Furnishings located in a medium sized metropolitan area. This has traditionally been "smoke stack" community populated by "me too" stores promoting major brands at competitive pricing and one higher-end store selling major lines and offering executive design services.

Her stores, now doing $45 million in sales, cater to a demographic of affluent 20 to 40 year olds, many of which are employed in the area's new computer industry. Janie shops the market tirelessly to find "cool" mid to high-end furniture and accessory items that will appeal to her customers. She also offers limited design services and carries several lines from major manufacturers. She is thinking of starting to carry "branded" merchandise. Janie's customers have very little time to shop, and have deep pockets. They either are impulse buyers or want the whole design job done for them. They are highly mobile, but also tend to be loyal.

Janie draws up tables 1-3 that look at her important strategic thrust areas and component attributes.

First Janie and a team composed of her department heads, determine the importance of each of the attributes in her market (column "A"). This forces her to think about really defining and understanding "what business she is in." The way she defines her competitive and potential market (narrowly or broadly) will greatly affect the results of her exercise. She assigns a value of 1,3 or 5 to each attribute, one being lowest importance and five being the highest importance.

Next, the team looks at the opportunity for the company if they could make those attributes a core competency of her organization (column "B"). This is also done by assigning a value of 1,3 or 5 to each attribute, one being lowest opportunity and five being the highest opportunity.

They then calculate the value of each attribute to the organization by multiplying the values assigned to "A" and "B" to come up with an overall value. The top five priority attributes are chosen to consider in the formulation of an action plan.

Finally, Janie's management team discusses the implications of these decision matrices and develops a strategy and plan to focus and build the top five attributes identified by this process.

Examples of what the fully filled out matrices for Janie's Cool Furnishings might look like are shown in Tables 1-3. A brief discussion of four selected attributes (contained in these tables) follows.

Cost Effective High Volume Producer: Even though the demographics is shifting to a younger, more affluent population, the largest group still consists of a solid base of middle income buyers who are willing to shop around for traditional furnishings at promotional or "sale" prices. The team decided that the importance of the "cost effective high volume producer" attribute is high in their marketplace, so they assigned it a value of 3. They also decided that this end of the business was brutally competitive and suffered from low margins and high sales employee turnover. They decided that this option did not represent much of an opportunity for Janie's "Cool" Furniture. They placed a value of 1 for this attribute in column "B".

Solutions Provider: The young, affluent demographic segment that represents Janie's primary customer, is interested in more than just buying furniture. They continue to be receptive to the idea of allowing Janie's salespeople to make house calls. This, customers feel, saves them time, provides more personalized service and frees them from the worry of making costly mistakes. Although one other store in the area offers more traditional decorating services, neither Janie nor the other competitors are currently capable of offering comprehensive services to meet this need. Hence the management team assigned a value of 3 to the importance of this attribute and to the resulting opportunity they gave a 5.

Rapid Response to Customer Demand: Janie's targeted customer segment does not care as much about rapid response as having unique design, personal service and convenience. Hence, Janie's team decided that it is not a very important attribute. They assigned a value of 3 in column "A", but since they believed that there may be an opportunity to take advantage of this in the future, they assigned a value of 3 in the opportunity column.

Forming Trust Based Relationships: As they turn even farther away from a low cost, high volume strategy toward meeting the unique and expensive taste of their affluent consumers, Janie's team knows that they needed to build a world-class design department. They discussed options for hiring in-house designers or partnering with interior designers, architects and other retailers in related home sectors to provide the home design services that many of their consumers require. In addition, Janie's team realized they had to interact more frequently with their current stock furniture suppliers and custom furniture manufacturers to keep their mix of stylish but affordable items and higher-end custom designs. They felt that they did not want to stop selling mid price point home furnishings or affordable accessories because this was thought to be the best way to attract entry level purchasers who matched their basic demographic profile. Forming trust-based relationships on numerous levels was found very important for Janie in the context of the new marketplace and hence they assigned it a value of 5. They also saw a significant opportunity to be the dominant player in that customer segment and hence assigned a value of 5.

Action Plan

Based on their analysis Janie and her marketing team came up with a detailed plan that included the following initiatives:

- Create a new position of Alliance Manager to investigate the development of relationships with interior design professionals, architects, other retailers in related home sectors and manufacturing partners.

- Put together a task force with their partners to develop a framework to share information between them.

- Start an initiative to provide order fulfillment through the WEB.

Sekar Sundararajan is President, Libra Consulting Corporation, a leading business intelligence and decision sciences firm based in Bethlehem, PA. Libra Consulting specializes in supporting industry and government in crafting and implementing agile and mass customization strategies for the rapidly changing global marketplace. They provide consulting, training and decision support software services for their clients. International clients include Fortune 500 companies as well as small and medium sized businesses, across a variety of industries - furniture, food, appliance, automotive, and government. A short list of clients includes Stanley Furniture, Whirlpool, Ford, Kraft Foods and the Commonwealth of Pennsylvania. As, Executive Partner, of the Iacocca Institute at Lehigh University, Sekar has been at the forefront of the Agile Manufacturing revolution taking place in the U.S.. He was an invited industry representative to the Iacocca Institute at Lehigh University, to create the vision for 21st century manufacturing. His expertise is in the areas of agile strategies, reshaping value chains, lead time reduction strategies, supply chain optimization, theory of constraints, and plant design. Direct questions or comments to editor@furninfo.com.