Fraud-proofing your documents & forge-proofing your signature.

"Simulated Forgery" left and true signature samples right.

Editor’s Note: Editor’s Note: In the August/September issue of FURNITURE WORLD, Jim Blanco exposed common external fraud schemes such as bogus credit cards, negotiable instruments and counterfeit merchandise receipts. In October/November and December/January he looked at internal embezzlement schemes, bogus invoicing scams, merchandising scams and time card schemes. In this issue his series concludes with additional causes of concern for furniture retailers.

There are many forms of document fraud that may affect your loans, leases and other important contracts and agreements. These types of fraud fall under the broad categories of "legitimate contract denial" and "bogus contract enforcement".

Legitimate Contract Denial

Legitimate contract denial occurs when parties seek to escape contractual obligations by claiming that a contract was improperly or fraudulently executed. This type of fraud can affect furniture retailers that have lease, loan or consulting agreements.

For example, one Sunday afternoon I was tinkering on my airplane when I received a phone call from a man who met me in Sacramento with a briefcase full of documents. His company needed to obtain proof that a vice president of their parent company had signed an agreement some years earlier. The parent company was trying to renege on an old obligation by denying the authenticity of their representative’s signature on a contract. As it turned out, the signature was authentic, and I sent this client home with a written report to that effect.

Another type of attack against authentic documents can side-step signature issues by focusing on alleged substituted pages that change the terms of the contract. In this rendition of legitimate contract denial, the manipulators aren’t trying to say that the entire contract is a fraud; they are just trying to argue away or change certain aspects of the agreement.

Bogus Contract Enforcement

This type of contract fraud occurs when a contract that has been altered or tampered with—or created without the knowledge of one of the alleged parties—is presented as a legitimate and binding document. Bogus contracts take several forms, which may also involve forged or misused signatures.

Forged Signatures

One type of bogus contract enforcement occurs when a person’s signature appears on a document that he or she never truly signed. In this instance, the signature is forged using one of the four common forgery methods. If this type of document emerges from an organization that you have already been doing some business with, they may have used your true signature from a document you sent them in the normal course of business, such as a letter or a previous contract.

It is very common today for the unscrupulous to "recycle" authentic signatures by copying them from authentic contracts and "pasting" them onto bogus contracts. In these situations, the forgers usually say that they do not have the original document. They argue that you destroyed the original in your possession. This is a convenient argument, to be sure, however, there is a remedy in such situations. If, they used a model signature of yours from a previous document in their possession, and if you have a copy of that document, it can be shown that the signature on the bogus document was taken from this previous authentic document.

Make sure that you keep copies of all documents you send out that contain your signature. If there is a "cut and paste" forgery of your signature later, the first point of comparison will be with copies of all documents sent to them, since these would have provided a resource pool of model signatures—your signatures.

In one example of bogus contract enforcement, an employee forged his boss’s name to an employment contract that forever assigned preferred stock in the amount of 15% to the employee "for consideration which has been received." The contract also guaranteed perpetual employment. The owner of the company had, of course, never agreed to or even seen the document.

A bogus contract or document may also emerge from a source that is unknown to you, who nevertheless claims that you have entered into some arrangement with him, her, or them. They produce a copy of a document, and you might even be convinced that the signature on it is one of your true signatures, but you know that you have never done any business with this company before. Keep in mind that there are four kinds of forgeries and that there are different levels of skilled forgeries. Some forgeries may be so skilled as to fool even you, so you must always check your memory and your records to be sure that you really haven’t done any business with this company before.

A word of caution is in order here: do not be one of those people who sign stacks of documents all at once without carefully checking the actual text. Bogus documents are sometimes slipped into a stack of documents, and the unsuspecting person signs the document without reading it over.

Substituted Page(s)

A restaurant owner sent documents to me for examination. He was having some problems with the State Board of Equalization, and wanted a document examined that was submitted to the Board bearing his alleged signature. An examination revealed a problem with the third page of the Sales Purchase Contract. The client remembered signing a purchase contract and thought that his true signature appeared on this particular page; however, the first two pages did not contain content that he had agreed to.

When inconsistencies in the copy quality and photocopy machine "trash marks" on the third page were pointed out, he realized that although the signature page was a true copy of an agreement that he had previously signed, pages one and two were brand-new pages that had been attached to the copy of the signature page.

Altered Contracts

In the “better and improved” contract scam, new ingredients are added to a preexisting authentic contract. For example, a resurfacing company had agreed to resurface an area for a property management company. The resurfacing company prepared a typewritten proposal of what they agreed to do for a particular dollar amount. Later, when challenged as to the quality of their workmanship, they produced their copy of the contract. It now contained the added handwritten phrase "Patched areas peeling around edges" to argue that there was a pre-existing condition that resulted in premature cracking soon after they had resurfaced the area.

However, this handwritten phrase was not included on the property manager’s original contract. By performing a solubility test of an area where some of the handwritten text intersected a dated rubber stamp impression, it was established that the disputed handwritten entry was added after the work had been agreed to and paid for. This proved that the resurfacing company had altered the original agreement in their favor.

Remedies to Document Fraud

These are precautionary measures you can take to greatly reduce the chance of document fraud being committed against you:

Don’t sign uncompleted forms:

Don’t sign documents "in blank"— that is to say, don’t sign a pre-printed form that has not yet been filled out. Sign only documents with all of the terms and information completely filled out.

Sign all pages of important documents:

When signing contracts, it is best to have each party sign on each page, as pages can easily be substituted. I have been present at the signing of court documents in Mexico, twice recently. Each person must sign every page of the pertinent series of documents before the parties leave. This procedure takes only an additional five minutes or so, yet adds great protection for all the parties involved.

Read contracts before signing them:

This might sound obvious, but you would be surprised at how many people sign documents without actually reading them. The truth of the matter is that if they had read certain contracts and understood the conditions, they would never have signed those agreements!

Leave your invisible link.

Here is a handy intrepid feature you can easily add that will link the signature page (last page) with the first page of a multi-page contract. When you are satisfied with the contract and are ready to sign, fold the signature page over the top of the first page of the agreement, then sign your name with a good healthy dose of pen pressure. By so doing you will leave an invisible impression of your signature indented into the first page. This "latent impression" of your signature can be visualized later to clear up any disputes.

Initial all handwritten changes or corrections to contracts.

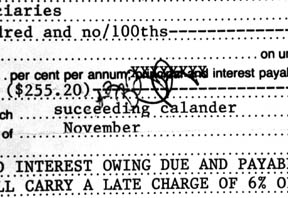

Initial changes any of the parties make to documents you sign. If a typed contract, for example, has been legitimately corrected or changed by handwritten interlineation, then you should initial the corrections. You should also make sure that every other party to the document also initials the changes. If a numeric amount has been changed, whether by hand or by machine, all the parties to the contract should initial the change.

Number pages of contracts.

It is expedient to number, title, and date each page of any contracts that exceed one page. That makes it more difficult for the person to duplicate the font size, typestyle, and locations of all of the writings on the pages.

Use systematic spacing.

When preparing contracts, make sure there are no large gaps or spaces between paragraphs. This makes it difficult for someone to add lines of text that would modify the contract. Make sure the line spacing, paragraph spacing, margins, and other formatting considerations are consistent throughout.

Keep original documents.

Keep copies of all documents you send out and receive, whether they are important contracts, simple invoices or faxes. As computer archiving becomes more popular, remember that when you destroy original documents after you have scanned or otherwise digitized them, you destroy your most effective evidence in resolving disputes.

"Forgeproofing" Your Signature

There are several things you can do to prevent the misuse of your signature. First, don’t write an abbreviated signature using only the initials of your name. As a rule of thumb, the fewer characters in a signature, the easier it is for the forger to succeed in producing the likeness of your written name, and the more difficult it will be to demonstrate that the signature is forged rather than authentic.

If you have been using an abbreviated signature, it is high time you started using most of the characters of both your given and surnames. I say "most" because if some of your characters become swallowed up in provocative flourishes and intricate and unique constructions and forms, then that can be advantageous, because intricate, stylized signatures provide the greatest deterrence to forgery.

Second, you should personalize your signature. The characters of your signature should not look like letters taken directly from the grade school handwriting charts that depict either the Palmer, the Zaner-Bloser, or the D’Nealian handwriting systems. By now, you should have injected some personal touches to the letters of your name with interesting constructions and forms to include your own distinctive brand of connecting strokes.

Third, write your signature rapidly, letting the dynamics of your personal motor control add further distinctiveness to your written name. There are certain restrictions to what your hand, wrist, and forearm can do, and there are other motions that come naturally to your hand. Lately, I have noticed some strange but interesting-looking lower-case cursive "f"s being spawned by my hand. I do not tell my hand to make these; they just occur. These are distinctive and have identifying value, so I don't fight it. While I have consciously instructed my hand to make certain other constructions, it has obeyed in some ways, but it has demonstrated its resistance and independence in the creation of other forms. In any event, writing your signature rapidly guarantees uniqueness and distinctiveness, which is what you want to see in your authentic signatures.

Remember that businesses lose billions of dollars every year to fraud. But by practicing the suggestions in these four articles, you will bolster your defenses against white-collar crimes and will save untold thousands of dollars in business losses and litigation fees. Remember, its far better to prevent fraud from happening in the first place than to try to get back what you have lost to a scam artist.

|

Three different people have initialed the changed typewritten numeric amount of "$255.20." The original entry was whited out and then typed over. |

A former Federal and State Government Forensic Document Examiner, Jim Blanco is owner of Blanco Forensic Documents and Fraud Prevention Services, located in Rocklin California. He is a speaker and trainer in Fraud Prevention matters and author of “Business Fraud; Know It & Prevent It.” You may contact Jim care of FURNITURE WORLD at

jblanco@furninfo.com.