Flexible Budgeting lets you ‘Flex’ your top line and observe

the resulting operational effects on your P&L and operating income.

We have all heard the saying, “A failure to plan, is a plan to fail.”

Most home furnishings retailers don’t have a plan. I did say most. The best operators do plan. They use budgets to help them react faster to unforeseen situations in the future. A quantifiable plan is a budget.

To introduce you to the value of budgeting, this article will show you how you can use a simplified “Flexible Budget” to assist with your operational forecasting.

This process is called “Flexible” because your planned level of sales may change due to unforeseen factors. For example, if your local economy is dominated by a large employer that suddenly lays off half of its work force, there may be a spillover effect on your business. Flexible budgeting allows you to prepare better for the unknown.

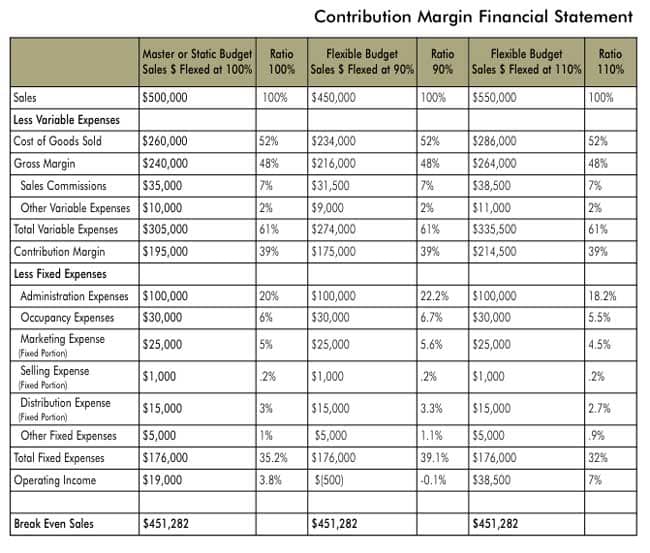

Flexible Budgeting lets you “Flex” your top line and observe the resulting operational effects on your P&L and operating income. To see these effects, a nontraditional financial statement will be used that separates variable expenses and fixed expenses. This is called a contribution margin financial statement and can be used for internal reporting, planning and analysis. The separation of variable and fixed expenses are important because they act differently when sales volume changes.

Examples of variable costs in the retail environment are cost of goods sold, sales commissions, finance company fees, and a portion of marketing and distribution costs. These expenses are only incurred when a sale is made. When you look at total variable costs, you see that as output (sales) increases, variable costs increase at the same rate. If you look at variable costs per unit of output, they remain fairly constant. For example, the ratio of sales commissions to sales may be 7% no matter what the output volume is.

The behavior of fixed expenses on the other hand is different. Total fixed costs will remain the same on a dollar amount over the relevant range of activity. For example, if rent is $30,000 per month, it’s going to be $30,000 per month whatever your output volume is, provided you’re in business. Conversely, fixed costs per unit of output decline as output increases. So, if your sales levels increase, you pay less as a percentage of sales. The spread of the increase or decrease directly adds or takes away from bottom line profitability.

Flexible Budgeting Basic Retail P&L Example

The place to start is with your actual financial statements that you produce in your software system. From your P&L, identify which balances are variable expenses, which are fixed, and which are mixed. From there you can use a spreadsheet to create a contribution margin financial statement similar to the one shown above.

Enter your master budget numbers. This is your most likely scenario. In the example, monthly sales are targeted at $500,000. It’s also important to note here that many businesses experience seasonality, so master budget sales numbers often should differ from month to month. After sales come variable expenses. Start with cost of goods sold as that is the largest variable component in retail. From there you can see your target gross margin. After gross margin, enter your other common variable expenses such as commissions. Here I lumped all the other variable costs in one category. You can separate the individual costs out if you deem them to be of material importance.

Subtracting total variable expenses from sales gives you your contribution margin and resulting contribution margin ratio. Contribution margin percent shows the percentage added to net income once fixed expenses are covered. So here, once the business is over break even, every $1 increase in sales adds $.39 to operating income.

After contribution margin, all fixed expenses should be subtracted. This results in the net operating income for the month’s sales.

If you are creating a contribution margin statement, take the next small step and figure your break even. As explained in my article in Furniture World on “Break Even for Retail”, the formula is: Break Even Sales $ equals Fixed Expenses divided by Contribution Margin Ratio.

Note: You cannot figure your breakeven properly without a contribution margin financial statement.

So, what would happen if your master budget projection is not correct? Well, let’s find out. That is what Flexible Budgeting is for!

Look at the example again. In the center column to the right of the master budget, we have two Flexible Budget scenarios: the first flex sales at 90% of the master while the second flex sales at 110% of the master. Look at the variable expenses as a dollar amount - they change. However, notice the ratio (percentages) to sales? They are exactly the same for all scenarios. That is the nature of variable expenses. While changing sales levels, variable expenses have no additional impact on profitability. Contribution margin is exactly the same.

Now, look at the fixed expenses of both the 90% and 110% flex scenarios. Here the dollar amounts do not change because they are fixed. But, the percent of sales amounts change due to the decrease and increase in sales. You can see that in the 90% flex scenario the fixed costs are higher as a percent, and all profitability has been eroded. Alternatively, in the 110% flex, a healthy profitability is reported. Although not shown in this article, these results are also taken further and compared with balance sheet projections and extrapolated for outcomes of cash flow levels, and inventory and payables ratios for example.

The break even in all three scenarios, the master budget, the 90% flex, and the 110% flex are identical.

The BIG lesson here is... Stop guessing! Take surprise out of the equation. Study the variable and fixed nature of your operational costs and plan for various scenarios. This will maximize your chances of success and allow your operation to grow more profitably.

David McMahon is a Management Consultant for PROFITconsulting and long-time writer for Furniture World. Please feel free to contact him if you want help improving your business. davidm@profitsystems.com.