Lower your breakeven point and hang on to your cash reserves.

Financial Management by David McMahon

During the recent recession, high exposure to risk forced lots of good retailers to go out of business. The culprit in many instances was high fixed costs relative to total costs. When consumer spending suddenly slowed, businesses were unable to respond in time. These retailers simply fell uncontrollably and quickly beneath their break-even point of sales. Losses were incurred, and eventually their cash flow dried up

Many businesses did survive the recession and remain profitable. They are the businesses that have a greater proportion of variable costs (lower fixed costs), and, therefore, shoulder less risk. You see, businesses with more variable costs in lieu of fixed costs are less susceptible to sudden changes in sales volume. Variable costs rise and fall in proportion to sales and result in a lower break-even point of sales. This gives retailers an advantage over their competition in that they have more time, or room, before their cash reserves are depleted during a sudden sales slump.

This article will demonstrate how to calculate your break-even point of sales. It will also provide some real world examples of ways smart retailers are reducing their break-even points. Finally, at the end of this article is an offer to get a free break-even calculator that you can use to improve your business.

So, what is the formula for break-even sales?

First, you need to have a clear definition of Fixed and Variable costs:

Fixed costs: These are costs that do not change when sales fluctuate. Examples are administrative costs, occupancy costs, and salaries.

Variable costs: costs that go up and down with sales. Examples are cost of goods sold, sales commissions, finance company fees, and credit card fees.

What complicates the retail costing environment are the mixed costs. They are a mix between fixed and variable costs. Examples are: advertising costs, distribution costs, and customer service costs. To get a firm grasp on how mixed costs affect your business you need to ask yourself: if sales go up or down… does this cost stay the same and, if not, how much does it fluctuate?

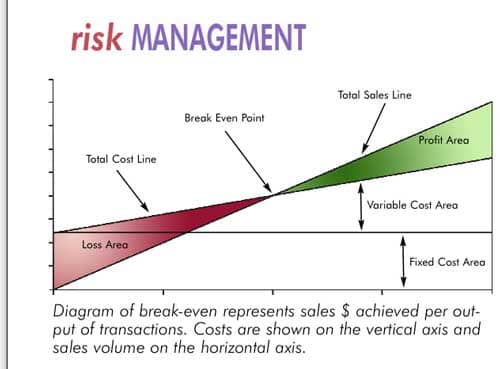

CALCULATING BREAK-EVEN

Once you have a good grasp of your cost types, you can calculate your contribution margin ratio. This is the point where fixed costs are covered. Any sales above that level contribute to profits at your contribution margin rate.

Contribution margin % = (Sales – Variable Costs) / Sales

Let’s use the real life example of a store we will call XYZ Furniture Stores. This retailer has sales of $6,000,000, variable costs of $3,800,000 and fixed costs of $1,500,000 then,

Contribution margin % = ($6,000,000 - $3,800,000) / $6,000,000 = 37% (rounded up from 36.67% for this article).

What does a contribution margin ratio of 37% mean? It means that after fixed costs are covered, 37% of any sale is straight profit. The remaining 63% are variable costs.

So once you know your fixed costs, variable costs, and contribution margin you can easily figure your break-even point of sales.

In the example cited above, retail break-even for XYZ Furniture is:

Fixed Costs /Contribution Margin ratio = $1,500,000 / .37 = $4,054,054

This company needs to reach $4,054,054 in sales before it makes 1 cent in profit out of total sales of $6,000,000. This is where the old saying comes from that “Retailers don’t make 1 cent until black Friday.”

However, we all know that is only used in a metaphorical way when thinking in terms of a calendar year. Profit is made each and every day once you crest your daily break-even point. But due to the weekends being responsible for the “lion’s share” of business, you should express your break-even as a monthly sales threshold.

The monthly break-even sales level for XYZ Furniture Store is $4,054,054/12 =$337,837 (without seasonal fluctuations). This is the minimum level of sales that adds to cash rather than subtracting from it.

REDUCING YOUR BREAK EVEN POINT

Now that you are tracking break-even properly, you CAN improve it.

It’s never too late to switch fixed expenses to a variable structure or transition to a greater variable proportion of mixed expenses. This will reduce your risk exposure (financial leverage) and maximize cash flow over the years.

Listed below are some real world examples of how smart retailers are reducing their break-even:

- Use a Contribution Margin Financial Statement so you can easily calculate your break-even every month. This consistent tracking enables you to react FAST.

- Focus on margins.

- Increase availability of warranty programs. If a dealer increases GM, their BE falls. Warranty is the fastest way to increase GM$ because when sales go up, Cost of Goods Sold goes down, and BE decreases.

- Offer various financing options.

- Use variable sliding sales commissions on gross margin.

- Pay delivery crew by the stop or piece rather than on salary.

- Set departmental budgets based on sales levels rather than just dollar levels – administrative, warehouse, and advertising.

- Renegotiate rent as a percent of sales rather than fixed cost.

- Set inventory levels that are based on sales levels to incur variable carrying costs (15-16% of sales is appropriate for a home furnishings business. For a bedding operation it would be much less.)

- Track return on advertising dollars more closely with respect to selling opportunities and traffic online and offline.

- Employ efficient systems, procedures, and equipment in business operations.

- Develop effective and fair vendor credit programs.

- Pay managers and owners as a percent of sales and profitability rather than just straight salary.

- Invest in advice and training that impacts profitability and improves sales.

Now that you have some practices that will decrease break-even, what results can you expect?

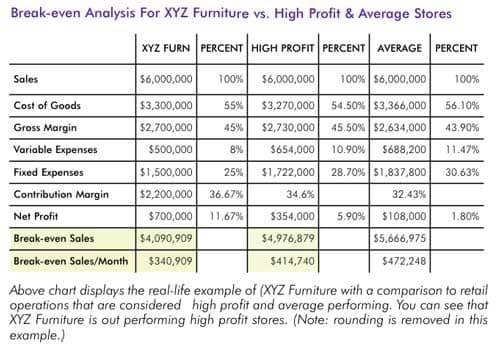

Please refer to the spreadsheet on the following page. Again, XYZ Furniture is generating $6,000,000 in annual sales.

First let’s figure net income using the formula: Net income = Sales – Variable Costs – Fixed expenses.

In this example, the company has a net income of $700,000 per year = $6,000,000-$3,800,000-$1,500,000.

That’s a 12% bottom line ($700,000 / $6,000,000 = 11.67%). And, by the way, this is a real furniture retailer that brought 12% to their bottom line last year!

Here is a little bonus calculation for you. What if you have done everything you possibly could? You have established the lowest break-even possible with your individual circumstances. Now, you want to figure out how to prosper further. How many extra sales dollars do you need to produce your desired profitability and subsequent increase in cash flow?

Let’s use our real life example of XYZ Furniture whose management team, said, “We want to be able to get our profitability up by an extra $100,000 this year. Although we continually seek to improve our break-even we feel that we have an efficient and effective structure in place. What sales increase do we need to get that extra $100,000 in profit?”

I responded, “Your sales last year were $6,000,000 and you produced $700,000 in net income. All we need to do is take your fixed costs, add in your desired operating income and divide by your contribution margin %.”

This was all done in seconds from their contribution margin financial statement. We joked that it took longer to have the printer generate the paper than to answer this important question.

I added, “If your contribution margin remains constant, you will only need sales of $6,216,216 ($1,500,000 + $800,000 / 37%) or just an increase of $18,018 per month. And based on the sales equation of Average Sale x Traffic x Close Rate, that’s just a few more be-backs in the door every month or a couple more house call visits.”

We all agreed that with proper management, training, and execution an extra $100,000 was possible!

The lesson here: Think PROFIT first and then translate that to SALES.

Offer To Furniture World Readers:

Some powerful analysis tools have been presented in this article, but you can create a more automatic Contribution Margin Financial Statement directly from your data. Contact David at davidm@furninfo.com to arrange a discussion about figuring your break even.

David McMahon is a management consultant for PROFITconsulting, a division of PROFITsystems, Inc. For a complimentary discussion and demonstration of how you can become a better retailer and e-tailer, contact David at davidm@profitsystems.com.